A new government-commissioned study on UK managed service providers (MSPs) has thrown up some interesting and potentially surprising findings.

Commissioned by the Department for Science, Innovation and Technology (DSIT) in July 2023, the independent market study is designed to explore the size and scale of the MSP market in the UK.

Here we run through eight of the most eye-catching talking points from the report.

1. MSP market is massive in magnitude

The sheer scale of the study’s headline figures may be a source of surprise to many.

By its (AI-supported) estimates, there are 11,492 managed services providers in the UK who together generate estimated managed services revenues of £52.6bn (their total revenues were pegged at £277.5bn).

The sector employs 294,340 staff, the study stated. It stressed that the sector makes a “significant economic contribution to the UK economy”.

These figures dwarf other estimates.

IT Channel Oxygen’s recent Oxygen 250 report pegged the top 250 UK IT channel partners’ total revenues at £26.8bn, for instance (and the majority of that figure would have been product resale). These 250 firms employed just over 70,000 staff.

The largest UK reseller Softcat, meanwhile, estimates its UK addressable market is around £60bn.

2. …But IT services giants lumped into research

Conducted by Perspective Economics (with data support from glass.ai) between June and September 2023, the report takes a wide view of managed services, lumping in international IT services and outsourcing goliaths with micro-businesses providing IT support to a small, local clientele.

Many reading this may be picturing an MSP as a small business that provides proactive monthly IT support to SMBs in their local area.

In contrast, the government-backed study encompasses some of the world’s true IT services and software goliaths, including Tata Consultancy Services, Capgemini, Computacenter, SCC, CGI, HCL Technologies, Sopra Steria, IBM, BT, Fujitsu, Accenture, Microsoft, Atos, PwC, and Oracle.

How did the study arrive at the 11,492 figure?

We’re glad you asked. Firstly, it identified over 4,000 potentially relevant MSPs and extracted over 500 keywords to inform a web crawl and web scraping (carried out by glass.ai).

The web crawl reviewed over one million active UK companies to identify around 16,000 potentially relevant companies to the study (which was then refined).

Large MSPs account for just 4% of the firms encompassed by the study, but generate 74% (£38.8bn), of total estimated revenue, the study found.

Mid-sized MSPs made up 9% of firms but generated 16% (£8.4bn) of total estimated revenues. Small and micro MSPs made up 28% and 59% of firms, respectively, but generated just 10% of total revenues, according to the research.

3. MSP growth going great guns

The UK MSP market has enjoyed 12% CAGR over the last five years, the study estimated.

This number is based, however, on just 184 ‘dedicated’ MSPs it identified who have reported full accounts throughout that five-year period (and the study’s definition of dedicated MSPs includes many of the IT services giants mentioned above).

Growth was softer during the pandemic-hit 2020, falling to 5.9%, it noted.

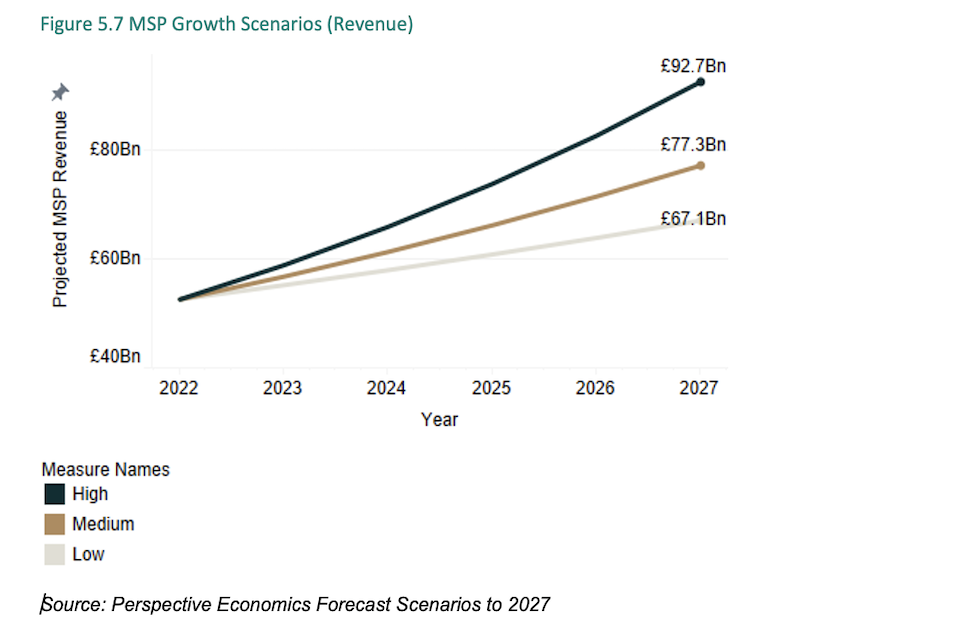

That 12% growth will only be maintained over the next five years under the highest of three growth scenarios the study set out, however (“medium” and “low” scenarios would see CAGR of 8% and 5%, respectively).

12% was the most optimistic number “given the increasing absolute levels of revenue, and potential for some natural slow-downs if certain providers reach a certain scale of delivery,” the study stated.

“However, applying a central rate of 8%, we estimate that the UK MSP sector could reach £77.3bn in annual revenues by 2027 (and up to £92.7bn should it maintain its 12% CAGR).”

4. AI and regulation to stoke growth

Increased use of new technologies such as AI, alongside regulation, were cited among the potential growth drivers for UK MSPs.

While new regulations (such as GDPR, NIS and Cyber Essentials) may come with direct compliance costs, they can also benefit MSPs that adhere to regulatory climates and can thereby “secure assured positions in the market”, the study noted.

The emergence of MSPs as a threat vector was pinpointed as among five challenges they will face, meanwhile.

“MSPs play a critical role in the security of UK organisations,” the report stated.

“However, as trusted partners to hundreds of thousands of UK organisations, they commonly have access privileges to client infrastructure, and securing and providing user rights to compute and storage functions. As such, MSPs are a high-value target for cyber-attacks – both due to the potential for ransomware (cost to third-parties, reputational damage etc), and the data held, as well as access to third-parties.”

5. Reading rears up as top MSP hotspot

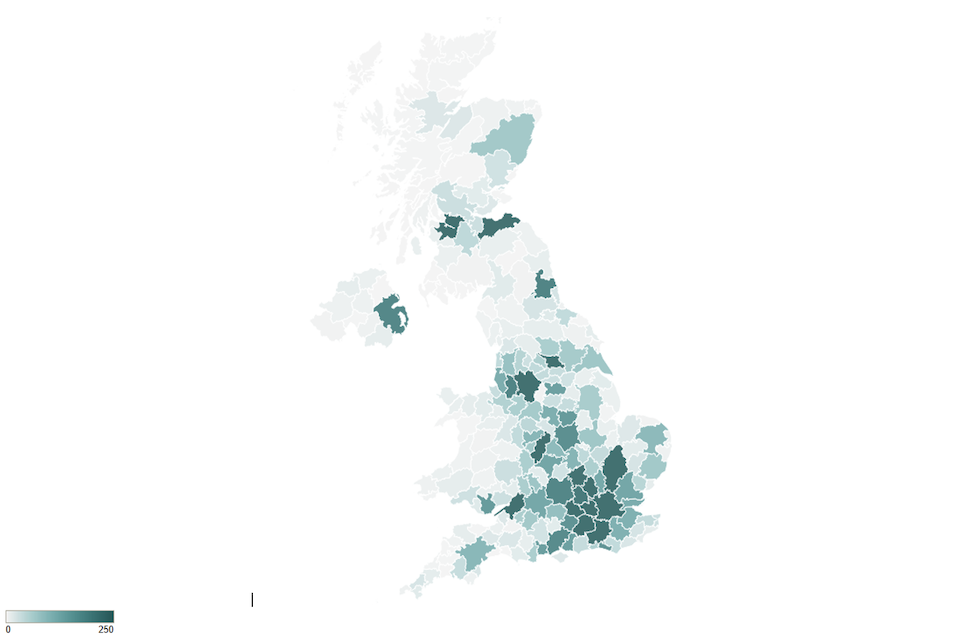

London (5,285 MSP offices), Manchester (955), Slough & Heathrow (746), Reading (472) and Birmingham (437) have the highest volume of active MSP offices in absolute terms, the study found.

However, the research also unearthed some MSP hotspots relative to business population.

As well as having one of the highest totals of MSP offices in absolute terms, Reading also has 2.5 times more MSP offices than you’d expect it to have based on its business population, the study found.

The Berkshire town was closely followed by Basingstoke (2.3x times more), Milton Keynes (1.9x), Guildford and Aldershot (1.8x), Leeds (1.6x), Bournemouth (1.6x more) and London, Brighton, Leamington Spa and High Wycombe & Aylesbury (all 1.5x more).

Figure 4.2 Heatmap of MSP offices (by Travel to Work Area)

6. The might of Microsoft

In Oxygen 250, Microsoft was mentioned in by far more of the profiles than any other vendor (89 times).

This also proved to be the case for the government study, based on a sub-section of 2,778 MSPs whose websites it looked at.

Over half (56%) of the providers have a partnership with Microsoft, it found, ahead of AWS (43%), Salesforce (19%), Google Cloud (7%), HPE (6%), Fortinet (5%), Fujitsu (4%), Dell (3%), Verizon (3%) and IBM Cloud (1%).

The study noted that partnerships are “core to the MSP ecosystem”.

“They provide MSPs with the capability and capacity to serve a wide range of clients, across an array of technical domains,’” it stated.

7. Hit and NIS

The government caused a stir in 2022 when it announced its intention to bring MSPs into scope of new regulations designed to keep digital supply chains secure.

The government-commissioned study had two main objectives, namely to build an understanding of the MSP market, and to understand the potential impacts of bringing large and medium MSPs under the scope of these Network and Information Systems (NIS) regulations.

It estimated that between 1,500 – 1,700 large and medium MSPs could potentially be impacted. Some 3,182 small and 6,623 micro MSPs would not come under its scope as they would be exempt, it added.

8. Shoring up the MSP sector

The study also explored several themes related to supporting the MSP sector’s growth.

There may be opportunities to work with providers on developing skills initiatives at a regional and national level, it said, for instance.

Noting that “only” 2% of dedicated MSPs identified in its analysis have received some form of external investment through fundraising in the last decade, the study also counselled that it may also be worthwhile exploring access to growth finance for high-potential SME MSPs.

“There may be potential to support cluster development and capacity building in geographic areas or sectors with potential for growth in demand for managed services,” it added.

“We find evidence of a diverse and growing sector,” the study concluded.

Doug Woodburn is editor of IT Channel Oxygen