AI at the edge has been branded a “remarkable opportunity” for the channel by Canalys Chief Analyst Jay McBain, as expectations for AI PC sales continue to ramp up.

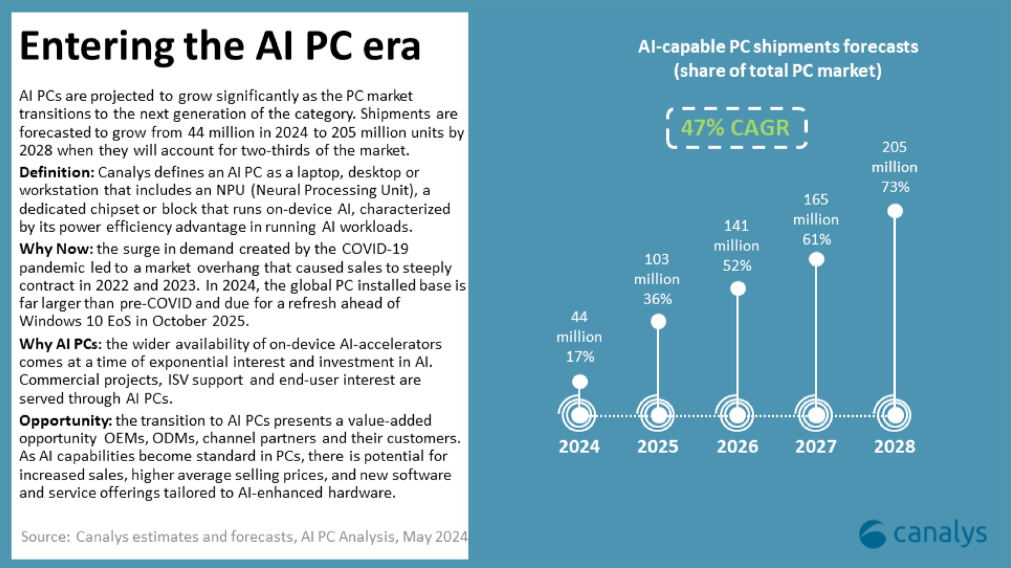

Defined as laptops, desktops or workstations that include an NPU (Neural Processing Unit), AI PCs shipments are set to hit 44 million units this year, according to the analyst’s latest forecast.

That would represent 17% of the total PC market, a figure Canalys expects to swell to 36% in 2025, 52% in 2026, 61% in 2027 and 73% in 2028.

An edge on the competition

As AI capabilities become standard in PCs, there is potential for “increased sales, higher average selling prices, and new software and service offerings tailored to AI-enhanced hardware”, Canalys said of the channel opportunity.

In a LinkedIn post, McBain characterised the wider AI at the edge opportunity a “remarkable opportunity for channel partners around the world over the course of the next decade”.

“First, with 85% of the world’s business data currently sitting on premises, the plans for training and tuning large language models (LLMs) will not involve forklifting this data into public clouds. The opportunity for Gen AI services will grow to $158 billion by 2027 according to Canalys, a 59% CAGR,” he wrote.

“Second, with the on-device execution of these models at the edge (PCs, smartphones, smart devices, wearables, self-driving cars, drones, etc.) partner services opportunities will outpace the device growth (40% to 47% CAGR for smartphones and PCs over next 4 years).

“Third, servers (already up 105.5% y/y last quarter), storage and networking opportunities to train and tune these models with business data will create a solid double-digit growth in related services. In fact, we recently highlighted our parent company Omdia research showing a 19.7% CAGR growth opportunity at the intelligent edge – pulling telco into the mix.

“It is also important to take a deep breath. As the famous Bill Gates quote goes… we are overestimating the hype cycle in the first 2 years, but underestimating 10.”

What the vendors are saying

McBain’s comments come as the vendor buzz around AI PCs continues to grow.

On HP’s recent Q3 earnings call, CEO Enrique Lores said consumer AI PC shipments in its second half (ended 31 October) will be slightly above the 10% it previously predicted.

But HP hasn’t yet seen a significant impact from the so-called “next-generation” AI PCs it announced this summer, he stressed.

“We expect next-generation AI PCs to represent around 50% of shipments in 2027, three years after launch, and they drive an average selling price increase between 5% and 10%,” Lores said on the earnings call, a transcript of which can be found here.

On Dell’s recent Q2 2025 earnings call, CFO Jeff Clarke branded the opportunity around AI at the edge “immense”.

“When you think about running these small language models with larger memory footprints on the edge on your PC to do amazing things and having a personal agent on your, if you will, screen helping you along the way, that’s all in front of us,” he said, according to a call transcript (see here).

On Monday, Apple showed its hand in AI by launching the iPhone 16, which CEO Tim Cook said will “push the boundaries of what a smartphone can do”.

“We have learned quite a bit over the past few weeks about what AI at the edge is going to look like, including Apple‘s announcements on Monday,” McBain concluded.