Softcat’s shares this morning nudged their highest value in more than three years after it raised its full-year guidance.

In a trading update this morning, the LSE-listed giant said it “performed well” during its Q3 ending 30 April 2025 – prompting it to raise its operating profit growth forecast for the year.

It now expects FY 2025 operating profit to swell by “low teens”, up from “low double-digits” previously.

Softcat’s shares shot up 4.4% in early morning trading, briefly thrusting its market valuation to a high not seen since November 2021. It is currently worth over £3.6bn, compared with Computacenter’s £2.75bn valuation.

The Marlow-based giant’s share gains come amid a wider recovery among European reseller stocks, as flagged up by Canalys Founder and Informa Fellow Steve Brazier.

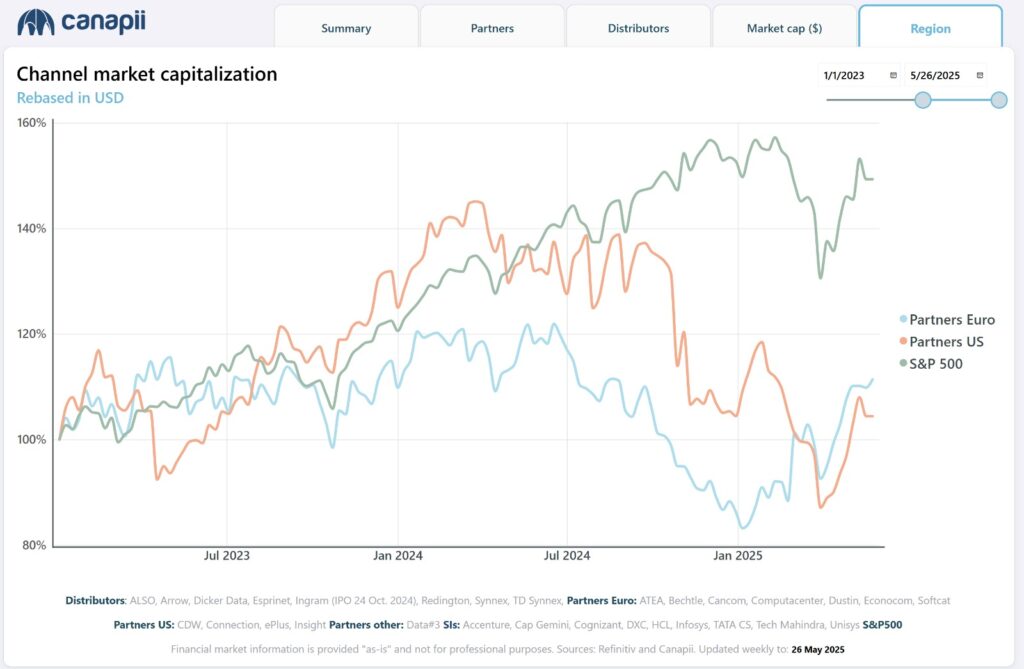

Having recently lagged behind their US peers, European partner valuations have in 2025 recovered strongly (and indeed now narrowly best them when looking at their respective performance since 1 January 2023 – see above).

Brazier picked out Softcat – whose market cap is up 44% since the start of 2024 – as a star performer alongside Nordic peer Atea (up 20%).

Softcat’s upbeat trading update comes after the Marlow-based giant smashed expectations for the first half of its fiscal 2025. Noteably, it made the first acquisition in its 32-year history in April.

“There are many factors involved in Softcat’s recent share price performance, but by far the most important one is that they have reported exceptional results,” Brazier told IT Channel Oxygen this morning.

“On top of that, the weakening dollar has helped with product pricing, Win10 end of life is boosting the PC market, and some investors have been moving cash out of the US into Europe/UK. Meanwhile cybersecurity remains a gift for all involved, including Softcat, as Infinigate’s results just confirmed too.”