Computacenter has officially broken through the £10bn barrier.

The landmark moment, however, received little fanfare in the LSE-listed giant’s annual results statement this morning, with CEO Mike Norris instead waxing lyrical about Computacenter’s profit growth and decision to beef up strategic investments.

The UK was fingered for its “disappointing performance”, meanwhile.

Here we round up the key talking points.

Computacenter joins ten-figure club – but CEO not bothered

Having turned over £5.4bn as recently as 2020, Computacenter’s top line smashed through the £10bn barrier in calendar 2023 (as previously trailed by IT Channel Oxygen).

Gross invoiced income (GII) came in at £10.1bn, an 11.3% rise on the previous year thanks to its bumper first-half.

Breaking that down, product resale (‘technology sourcing’) GII bounced 13.1% to £8.44bn, professional services GII by 5.7% to £678.8m and managed services GII by 1.3% to £957.7m.

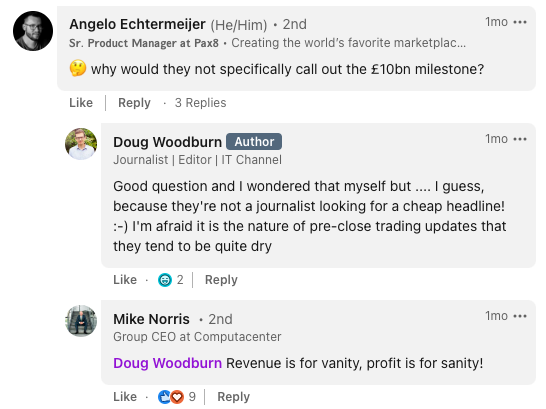

If breaking the ten-figure barrier meant anything at all to Computacenter Mike Norris, he didn’t let on his CEO commentary (perhaps his comment on a previous IT Channel Oxygen post below says it all).

Still, Norris claimed the reseller and services goliath “grew faster than both the market and our major competitors and have gained further market share as a result”.

Unbroken profit growth streak continues

Instead, Norris used his commentary to emphasise that Computacenter has now delivered nineteen consecutive year of growth in adjusted earnings per share.

Adjusted operating profit rose 0.6% to £271.5m, despite inflation denting its services gross margins during the year.

Computacenter’s expansion into North America via acquisition over the last five years (alongside organic growth) has delivered a “step change in profits”, Norris added. Adjusted profit before tax and adjusted earnings per share have more than doubled during that period, he said.

Computacenter almost doubled its investment in strategic initiatives (from £14.8m to £28.1m) in 2023 in an effort to boost its capabilities, enhance productivity and secure future growth.

“Most of the investment is focused on our systems,” Norris explained.

“We are not just upgrading but also moving to new systems to obtain the security and support we need and to develop competitive advantage through new toolsets and processes, all of which will help secure future growth.”

The Hatfield-based giant expects to more than maintain that level of investment in 2024, when it predicts its strategic initiatives spend will hit £28m-£30m.

UK a fly in the ointment

The UK was the only notably blot on Computacenter’s 2023 copybook, with Norris admitting its performance in its home market was “disappointing” as he lavished praise on its North American and German arms.

Although UK gross invoiced income of £2.38bn was up 2.4% (just shy of Softcat’s £2.56bn fiscal 2023 GII number), adjusted operating profit fell 27% to £58.8m.

Norris put this down partly to “higher exposure to subdued workplace demand”.

“We responded by making changes to our UK leadership team and our sales approach and saw the benefits start to come through at the end of last year,” he said.

Breaking down the UK performance, technology sourcing GII rose 4% to £1.938.1bn. But professional services GII was down 10.4% to £132.2m, while managed services GII slipped 1% to £309.7m.

Echoing Softcat’s remarks in October, Computacenter said the UK market “softened during the year due to unsettled economic conditions”.

In contrast, Computacenter deployed a range of superlatives for its other operations, with its German arm’s performance billed as “excellent”. It saw adjusted operating profit rise 13.8% to £163m on GII that hiked 21.7% to £2.88bn. North America, now Computacenter’s largest operation, saw “strong growth”, with GII up 11.2% to £3.6bn and adjusted operating profit rising 24% to £65m.

Computacenter saw “positive momentum” in France and put in “strong performances” in Belgium and the Netherlands, meanwhile, Norris said.

2024 growth will be weighted to second half

The “exceptional demand” Computacenter encountered for product resale in the first half of 2023 will mean it is running up hill to match that performance in 2024, the company acknowledged.

The giant won some “significant” new managed services contracts towards the end of the year, Norris noted, however. On that note, Norris said that Computacenter now has nearly 1,400 staff in India, up from 1,100 at the end of 2022.

“Overall we expect to make further progress in 2024 with growth weighted to the second half of the year, reflecting a significantly more challenging comparison in the first half of the year than in the second half,” Norris said.

Norris concluded: “Looking further ahead, we are excited by the pace of innovation and growth in demand for technology. With our strength in technology sourcing, professional services and managed services, and focus on retaining and maximising customer relationships over the long term, we believe that we are well placed to deliver profitable growth and sustained cash generation.”