AWS is beginning to make some of its on-prem rivals look small as its revenue runrate broke the $100bn mark on the back of “reaccelerating” growth in Q1.

The public cloud giant saw revenues hike 17.2% to $25bn in the first quarter, up from the 13.2% growth it recorded in Q4.

Amazon CEO Andy Jassy chalked this up to a combination of companies renewing their infrastructure modernisation efforts and the appeal of AWS’ AI capabilities.

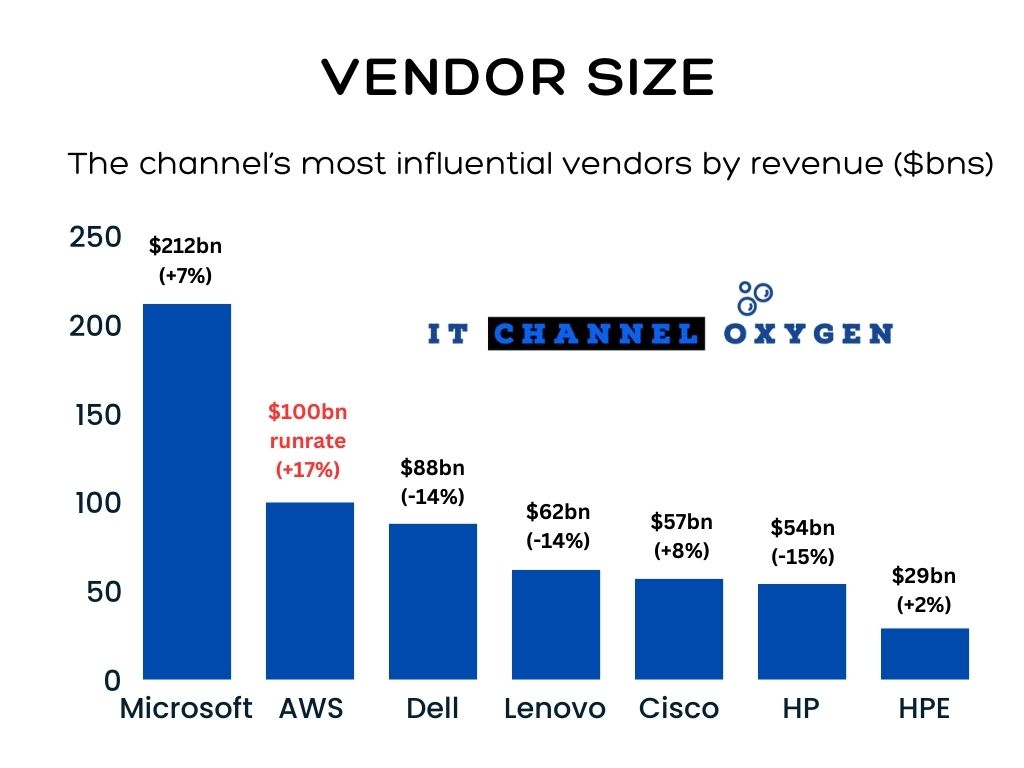

AWS’ frenetic growth in recent years means it now dwarfs some of the on-premises infrastructure stalwarts it sought to take on when it was founded in 2006 (see above).

While AWS continues to grow double digits, the likes of HPE, Dell and Lenovo have all seen their revenues fall – in some cases by nearly the same margin – in recent quarters.

On an earnings call (a transcript of which can be found here), Jassy said he remains “very bullish” on AWS.

“We’re at $100bn-plus annualized revenue run rate, yet 85% or more of the global IT spend remains on-premises. And this is before you even calculate GenAI, most of which will be created over the next 10 to 20 years from scratch and on the cloud,” Jassy said.

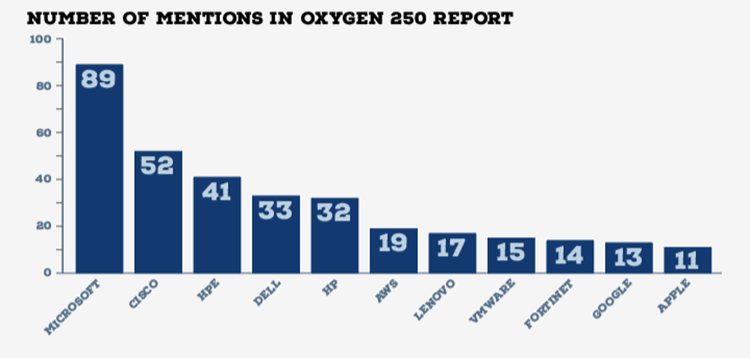

Despite its larger stature, AWS ranked only sixth (behind Microsoft, Cisco, Dell, HPE and HP) when it comes to number of mentions in the Oxygen 250, IT Channel Oxygen’s recent rundown of the top UK channel partners by revenue.

AWS is known for generating only a minority of its sales via the channel, compared with around 50% for Dell and a much higher percentage for the likes of Microsoft, Cisco and HP.

According to Canalys, some 71% of AWS sales were direct in 2023, with less than 30% through the indirect channel.

“That puts it number two behind Azure in terms of cloud channel revenue, even though of course AWS is larger overall,” Canalys Chief Analyst Alastair Edwards told IT Channel Oxygen.

“However that is only where the transaction flows through a partner or distributor – there is a large proportion of AWS direct business which has partner involvement in terms of services attach, but we don’t track that in our numbers.”

AWS’ growth rebound mirrors that registered by Microsoft, which saw the growth of its Azure-related business accelerate from 30 to 31% quarter on quarter in its recent Q3.

“Elsewhere, and pleasingly for the general market, both Google and Microsoft posted some strong numbers – also showing growth coming back. This isn’t a zero sum game, and the competition is healthy for all,” Chris Bunch, CEO of AWS partner D55 said in a blog post covering AWS’ latest results.

Companies have “largely completed the lion’s share of their cost optimisation and turned their attention to newer initiatives”, Jassy noted.

Doug Woodburn is editor of IT Channel Oxygen