What do the 50 ambitious companies featured in this Oxygen Fast Growth 50 have in common?

Before answering this, it’s important to address how they made the cut.

These 50 firms are the fastest-growing small to mid-sized UK MSPs and IT solutions providers on IT Channel Oxygen’s radar, based on the average monthly headcount figure in their last four sets of filed accounts.

To be eligible, they had to a) sit outside of IT Channel Oxygen’s Oxygen 250 (which had a revenue cut off of £15.7m), and b) employ 15 staff or more in their most recent years on record (as of 29 February 2024).

About the wider population

The 431 resellers, IT consultancies, IT solutions providers, MSPs and MSSPs on our radar that fitted these two criteria have seen headcount increase healthily over this three-year period, despite the straitened backdrop.

They formed the wider population from which the Fast-Growth 50 were drawn.

Together, these 431 companies’ combined average monthly headcount totalled 16,485 in their latest years on record (up 1,446 on the previous year).

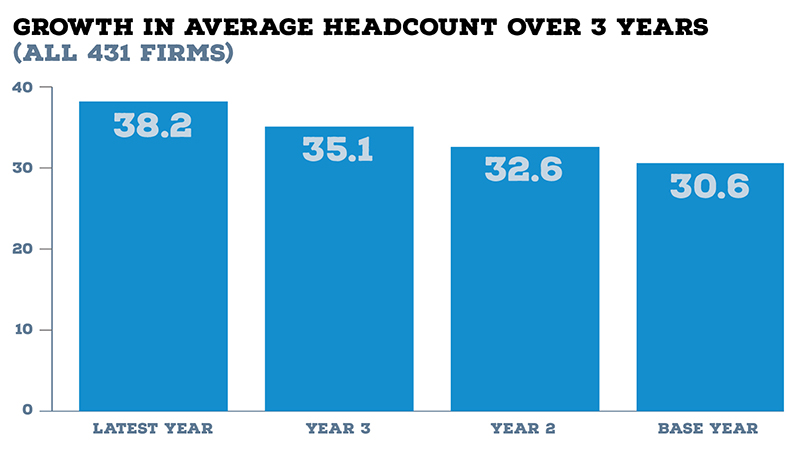

Looking at their mean average monthly headcount over the three-year period, it has risen from 30.6 in the base year to 38.2 in the most recent year. Some 266 grew headcount during that time, while only 83 saw it shrink.

Most of these firms are too small to divulge revenues in their annual accounts. The 90 that did registered combined revenues of £934.2m in their latest years. Going by average revenue-per-employee ratios, we would estimate that the wider population of 431 companies have combined revenues of around £2.56bn (compared with the Oxygen 250’s £26.7bn total haul).

Who are they, exactly?

We found them by scouring literally dozens of vendor partner locators, leaping into Companies House any time a new name came on our radar, and generally keeping our ear close to the ground.

Some 234 might describe themselves as MSPs, IT resellers or IT consultancies (typically doing a mix of all three). Some have a laser focus on more specialist areas, including ERP and business applications (36), cybersecurity (31), print and managed print (26), UC and comms (25), networking (18), cloud transformation (18), audio-visual (14), edtech (12) and data and storage (8).

Looking at their ownership, 395 are privately held, 20 are private equity-backed and seven are employee-owned. Only six are international firms (US – two, France – two, Ireland – two). One is owned by a charitable trust.

Who are the Fast-Growth 50?

The Fast-Growth 50 represents a high-growth microcosm of the firms above.

They made the cut based on a 50-50 split between absolute and relative average monthly headcount growth during the three-year period. A company that doubled headcount from 40 to 80 during the period would score twice that of a peer that increased from 20 to 40 staff, for instance.

We did, however, strip out any firm that did not show headcount growth in the latest of these four years, or those for which we could not obtain sufficient data (or data appeared to be missing).

On average, this elite cross-section’s average monthly headcount swelled from 24.8 to 58.4 during the three-year period.

Their combined average monthly headcount totalled 2,921 in their latest year on record – a 135% rise on the base year.

Due to their swift growth, many already employ substantially more staff than the average monthly headcount figure in their latest filed accounts indicates. Take Croft, which now has 190 staff but whose average monthly headcount stood at just 47 in its most recently filed accounts. Wherever possible, we have included a current headcount figure provided by the company themselves in the body copy of the profiles.

The nature of this report also means that some fast-growing UK channel partners have not made the cut because their headcount growth has not yet shown through in their formal accounts. Take Ingentive, a Microsoft partner that has grown from 20 to 65-70 staff since industry veteran Stuart Fenton acquired it last year, or Cardiff-based MSP Flotek, which has acquired 11 firms since it was founded in 2022.

Neither will our league table reflect the full size of channel partners that lean heavily on contractors.

This report therefore has some blind spots. But we wanted to create a league table based on formal data filed on Companies House, rather than using less reliable numbers on LinkedIn company pages, websites or hearsay.

Shared traits

What do these 50 firms have in common?

Relatively little, at first glance. But dig a little deeper and some shared traits emerge.

Ownership oddities

Firstly, there are a disproportionately high number of private equity-backed companies in the Fast-Growth 50, compared with the wider population from which they were drawn.

Eight (or 16%) are owned or backed by a PE firm, compared with just 20 (4.6%) of the wider 431 firms.

Considering PE’s reputation for backing management teams that ‘want to go on a journey’, often fuelled by aggressive M&A, this is perhaps hardly surprising.

The PE-backed firms in the top 50 include Quorum Cyber, a cyber specialist that has seen the highest absolute headcount growth of any of the 431 firms during the three-year period, as well as acquisitive MSP Zenzero.

Strength in cyber

The Fast-Growth 50 also skew disproportionately towards the high-growth niche of cyber-security.

Some nine MSSPs, boutique cybersecurity resellers and cybersecurity consultancies made the cut, meaning 18% of these elite firms are cyber specialists (compared with just 7.1% of the wider population).

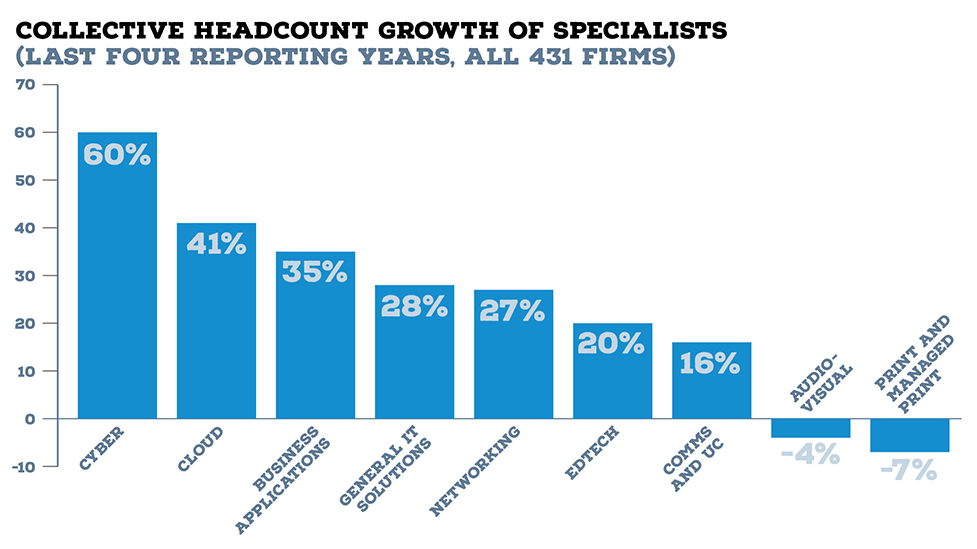

This is hardly surprising considering the headcount growth racked up by the 31 cyber specialists in the wider population. Their combined headcount flew up 60% to 1,333 during the period, making them the fastest-growing sub-breed of IT solutions provider ahead of AWS and cloud transformation specialists (41% headcount growth) and business applications (35% headcount growth).

Many more of the Fast-Growth 50, while not cyber specialists, see cyber as their number-one area for expansion.

In contrast, no managed print or audiovisual specialists made the top 50 (these being the only two specialist areas where headcount fell during the period).

Tight ties

Growth businesses rely on high levels of trust among their leadership, and who could you possibly trust more than a sibling or close friend? It’s worth noting that several of the Fast-Growth 50 are run by duos bound either by blood or childhood kinship.

848 Group was founded by brothers Kerry and David Burn in 2010, while Ramsac founder Rob May recently handed the CEO baton to younger brother Dan.

School friends Jamie Evans and Stuart Goldwater (pictured right) founded Pragmatiq in 2017, despite initially pursuing different career paths. The founders of Planet IT, meanwhile, set up a car washing business together aged 12, before graduating to IT support in 2003, while Quostar was founded in 2005 by two old university friends.

Launched in 2015 by a duo of Softcat executives, Saepio Solutions’ success is also characterised by the close bond between its leaders.

“Andy’s the heart, and I’m the brains,” Robert Pooley told us.

Stability in management is another trait common to many of the Fast-Growth 50, with even some of the more mature firms in this report being run by their founder or founders today.

Young guns

The very nature of a ranking list like this will favour young firms, with several of the Fast-Growth 50 founded in the last five years.

These youthful outfits are often looking to ruffle feathers with a new approach to sales or company culture. Simoda, for instance, includes all staff in its annual profit share scheme and operates a non-commission sales team.

“This ensures our focus remains on the technology rather than the sales person’s commission,” MD Daniel Bumby explained.

It is one of three firms in this report founded in 2019 alongside CYSIAM and Bedroq, with AlternIT One, Cambridge Support and Cloud Bridge all starting life in 2018.

The latter was born after its two founders spent five minutes scratching out some drawings of clouds and bridges on a beer mat. Having sold a minority stake to Bytes Technology Group in April 2023, it now employs 95 staff.

Mentality matters The Fast-Growth 50 firms we spoke to were at pains to point out “there is no secret sauce” behind their lightning growth.

Some, however, are noteworthy for going all in in their pursuit of becoming top dog in their chosen field. They tend to think differently – or bigger – than the competition.

“When we started the company, we had a mission of being the UK’s number one partner for cyber security in the mid-market private sector,” Saepio’s Pooley said, adding that he and co-founder Andrew Pitt “won’t want to stop until we’ve got there”.

“We focus purely on AWS mastery and being the best at it,” Cloud Bridge’s Simon Walker told us, meanwhile.

Others have grown following efforts to diversify or cross-sell more services into their customer base. This includes Croft, which is on a mission to move beyond its roots as a mobile telecoms reseller and reinvent itself as a managed IT provider.

“Right now, we have just under 5,000 clients. The idea is just grow the basket of solutions we sell into them,” Croft CEO Mark Bramley told us (see interview, p14).

OryxAlign, an IT support provider that has enjoyed growth by building a midmarket projects business, is another prime example.

“Our focus has broadened. We’re still very much an MSP, but we’ve evolved into project delivery and programme management and moved successfully into the midmarket,” CEO Carl Henriksen told us.

As if to prove the point that there is more than one formula behind their success, the swift growth of Cambridge Support came almost inadvertently, however.

“Cambridge Support was meant to be a lifestyle business,” Managing Partner Philip Mashinchi said of the IT support outfit, which has grown to 21 staff since its launch in 2018.

“It started in a tiny office in Cambridge without any plans to grow, no business plan and very little money. We are very fortunate to be where we are.”