The reseller-to-MSP pivot is really happening, Giacom Chief Strategy Officer Nathan Marke has claimed following the release of fresh data into where SMBs are spending their tech budgets.

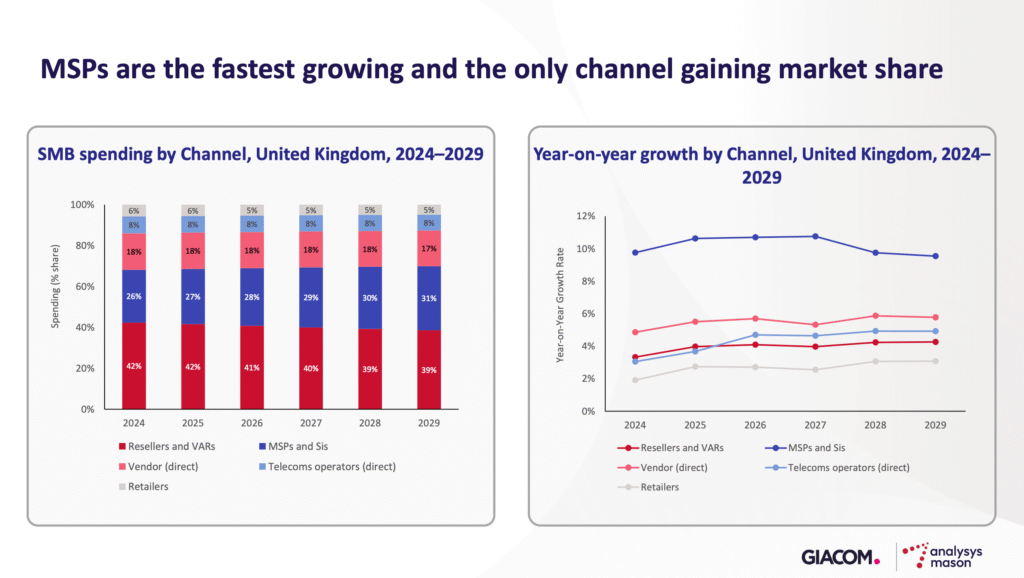

According to figures from Analysys Mason, MSPs’ share of UK SMB tech spending is set to rise from 25% to 31% between 2024 and 2029.

In contrast, resellers’ share of the spoils will drop from 42% to 39% over the same period, the analyst predicts.

Giacom conveys highlights of Analysys Mason’s SME tech spending research to its partners twice a year.

The dynamic its data uncovered shows that SMBs are seeking out more strategic IT partners post-pandemic, Marke claimed.

“What’s interesting to us is seeing this pivot from reseller to MSPs,” he told IT Channel Oxygen.

“The growth of classic resellers in SMB is only 2-3%, but the MSPs are growing at 10-11% so are getting 3x growth – and broadly we attribute that to SMBs believing tech is far more important to them.

“SMBs are now looking for a strategic partner, and MSPs represent that more strategic relationship around IT that perhaps this very fragmented reseller community of old, pre-pandemic, didn’t really represent.”

“The data shows how MSPs are continuing to gain market share as increasingly tech savvy SMBs seek a strategic partner to help them gain advantage from their technology investments,” Karthik Pannala, Principal Analyst at Analysys Mason added.

“Massive uptick” in switching suppliers

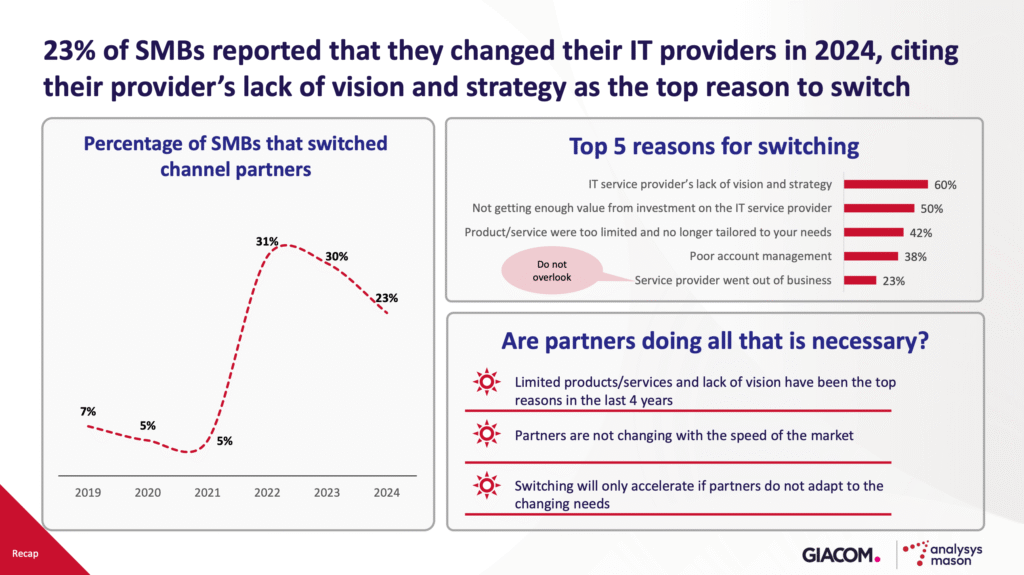

Analysys Mason’s data also suggests there has been a big uptick in SMBs switching tech suppliers since the start of the pandemic.

“There was hardly any switching going on before the pandemic, as small businesses didn’t tend to think tech was particularly important for them,” Marke said.

“Since the pandemic, there’s been a massive uptick in switching amid this drive from SMBs to look for a strategic partner, which I think is really significant.”

In total, SMBs – namely businesses with 1-500 employees – are set to spend $70bn on IT solutions in 2025, by Analysys Mason’s reckoning. That figure is set to rise to $89bn by 2029.

IT managed services generates a quarter of that total, closely followed by UC and digital services (22%), infrastructure (21%) and business applications (19%). Devices and peripherals (9%) and cybersecurity (3%) generate the remainder.

Marke said Giacom backs the research because SMBs tends to “get lost” in the more enterprise-focused IT spending forecasts of many market analysts.

“The vast majority of the reseller and MSP community don’t make their money from large companies, but from smaller ones. That’s why we think this is particularly interesting,” Marke concluded.