Runaway inflation may have added an artificial gloss to the top lines of the 250 firms in Oxygen 250 in their latest years.

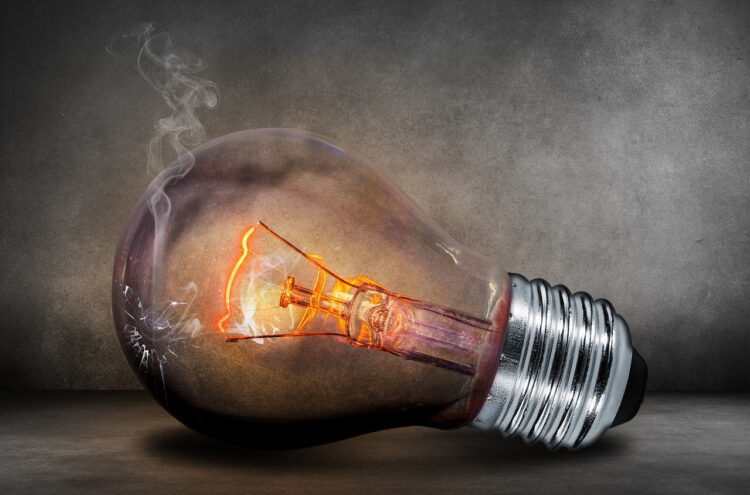

But one breed of firm was hit firmly in the wallet as energy prices spiralled in the wake of Russia’s invasion of Ukraine – those operating electricity-hungry datacentres.

The report, produced in association with Nebula Global Services, profiles the 250 largest UK IT resellers, MSPs and consultancies on IT Channel Oxygen’s radar, from £2bn-plus giants Softcat and Computacenter down to £16m-revenue niche outfits.

44th-ranked Iomart said the energy crisis added £7m to its electricity bill in its fiscal 2023, while 40th-ranked ANS blamed rising power costs at its datacentres – alongside wage pressure among technical staff – for a drop in its annual adjusted EBITDA.

30th-ranked Redcentric’s fiscal 2023 profits were hit to the tune of £1.7m by higher-than-anticipated electricity costs, meanwhile.

A raft of energy efficiency initiatives Redcentric has put in place are expected to yield an £8.4m reduction in electricity costs in its current fiscal 2024, CEO Peter Brotherton said.

More generally, not everyone was able to offload higher costs onto customers as quickly as they would have liked. 21st-ranked Banner, for instance, grumbled that “unprecedented levels of inflation” in calendar 2022 had a “material impact on profitability as costs were passed onto customers at contractually fixed points”.

High interest rates brought in to tame inflation also left their mark on the industry in 2023, with Canalys estimating that global M&A rates will be down 60% as private equity investors pull in their horns. Serving existing levels of debt has also become a bigger expense, with Iomart, for instance blaming high interest rates for pushing up its interest expenses up by £0.9m year on year.