Bytes Technology Group and Softcat lead a public sector VAR market that accounted for over a fifth of wider public sector IT spending in 2023/24.

That’s according to the latest figures from Tussell, which tracks public sector tenders, awards, frameworks and spending (download a snapshot of the report here).

Total public sector IT spending rose 2% to £16.9bn in the year to 31 March 2024, Tussell found, with the VAR market generating £3.7bn – or 22% – of that total.

Triumphant ten

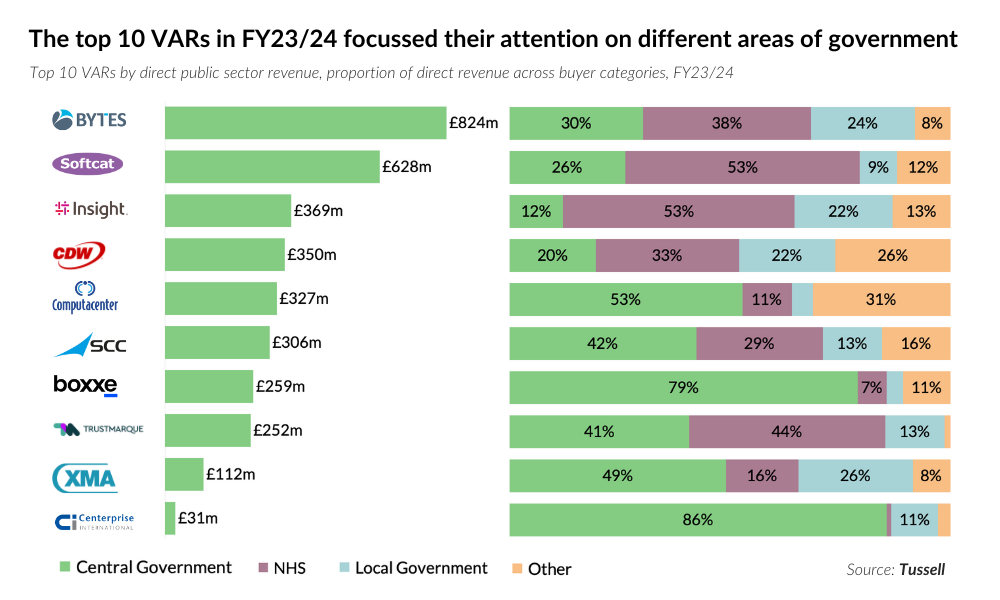

Bytes Technology Group (or ‘Bytes’ as Tussell has shortened its name to) and Softcat were the two dominant players, accounting for £824m and £628m (or 39%) of that £3.7bn haul, respectively. The former comprises both Bytes Software Services and Phoenix Software.

You could throw a blanket over the next six suppliers, namely Insight (£369m), CDW (£350m), Computacenter (£327m), SCC (£306m), boxxe (£259m) and Trustmarque (£252m).

XMA (£112m) and Centerprise (£31m) rounded out the top ten.

With the notable exception of World Wide Technology, that broadly maps onto the top ten players featured in the recent Oxygen 250.

Tussell’s data is based on direct procurement by government bodies with IT suppliers, categorised using relevant SIC codes, contract and framework analysis.

Bytes Technology Group and Softcat generated public sector gross invoiced income of £1.14m and £1.098bn in their latest annual results (see here and here), respectively, with the former seeing public sector sales prop up its fiscal first half of 2025.

NHS in good health

The top four in Tussell’s standings all drew a plurality of their public sector sales from the NHS, which it picked out as the public sector’s fastest-growing IT market since 2019/2020. Others, including Computacenter and boxxe, have more of a central government bent.

Some 31% NHS IT spending is with VARs, Tussell said, compared with 25% for local government and 15% for central government.

Looking at the public sector total, VAR marketshare has remained steady at 22-23% over each of the last four years.

The UK public sector IT market is “thriving”, Tussell said as it noted that public spending with IT suppliers has risen every year since 2019/20.

With new funding set aside in the 2024 Autumn Budget for transformation and AI, this growth will likely continue, it added.

“In the 2024 Autumn Budget, the Chancellor of the Exchequer, Rachel Reeves, promised to increase public sector efficiency – in part through digital transformation. Significant funding allocations have been put aside for FY25/26 to support NHS digitisation, AI adoption across government, increased cyber security, and new diagnostic scanners in the healthcare sector,” it stated.

Download a snapshot of the report here.