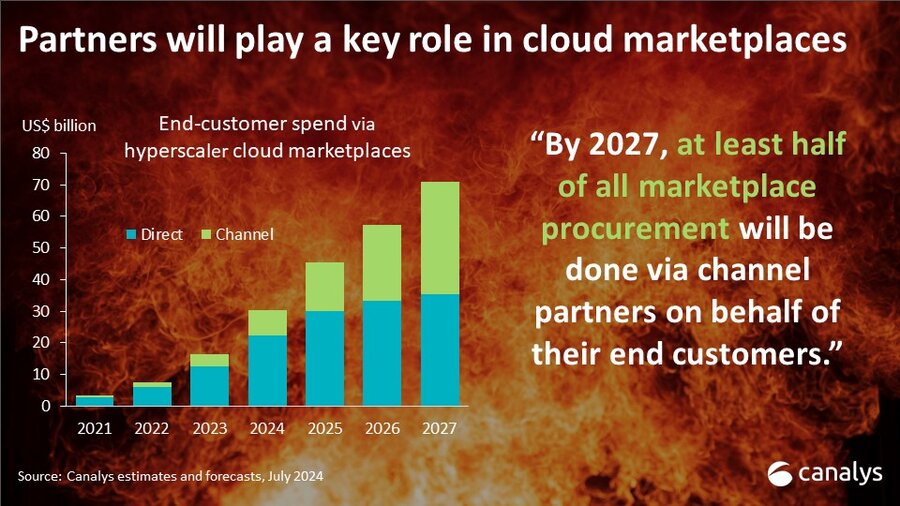

The channel may be “concerned” by the rise of hyperscaler marketplaces, but will nonetheless capture half the spending that takes place via this new and fast-growing route to market by 2027.

That’s according to Canalys, whose latest research report predicts that enterprise software sales through hyperscaler cloud marketplaces – led by AWS, Microsoft and Google Cloud – are projected to reach $85bn by 2028, up from $16bn in 2023.

As ‘digital distribution platforms’, hyperscaler cloud marketplaces are providing “increasing competition” for IT distributors, the analyst noted.

CrowdStrike (see here) Snowflake, Palo Alto Networks and Splunk have all reportedly now sold over $1bn of software through the AWS Marketplace alone.

But while most vendor sales via these marketplaces are today “direct” to end customers, channel partners “are playing an increasingly important role”, Canalys said.

It expects more than 50% of marketplace sales to flow through the channel by 2027.

Channel becoming “focal point” for hyperscaler marketplaces

Microsoft’s new channel programme within Azure Marketplace, Multiparty Private Offer (MPO), will be a $1bn business for the UK channel within three years, the person behind its launch told IT Channel Oxygen in May.

Its launch is a sign that the channel is becoming a “focal point” in the battle between the hyperscalers as vendors prioritise partner-first marketplace strategies, Canalys said. AWS has its ‘Channel Partner Private Offers’ model, while Google in June launched its ‘Marketplace Channel Private Offers’.

All three hyperscalers are trying to make it easier for software vendors to enable their partners to create customised offers on their marketplaces, while seeking to maintain margins for the channel, Canalys said.

“The channel has concerns about the rise of marketplaces, but both hyperscalers and vendors acknowledge the vital role of channel partners in driving customer adoption and growth,” said Alastair Edwards, Chief Analyst at Canalys.

“Customers often prefer buying through trusted partners for help with managing cloud commitments and accessing professional services and technical expertise when sourcing complex technologies from multiple marketplaces.”

Canalys’ research also brought encouraging tidings for distributors, who it said will be “important to reduce operational challenges for partners and vendors as [cloud marketplace] adoption grows and to support the growing number of second-tier partners whose customers want to buy this way”.