Infinigate’s CEO claims it is on course to hit its long-term €5bn revenue target after the cybersecurity VAD outgrew all its peers in its fiscal 2025.

The Switzerland-based Fortinet, Juniper and Check Point ally, which is backed by private equity house Bridgepoint Advisors, saw sales hike 17.5% to €2.7bn in the year to 31 March 2025.

The results mean Infinigate is “maintaining our growth trajectory” towards its €5bn revenue target for its fiscal 2027-28, CEO Klaus Schlichtherle said in a statement.

Digging into distribution’s dozen

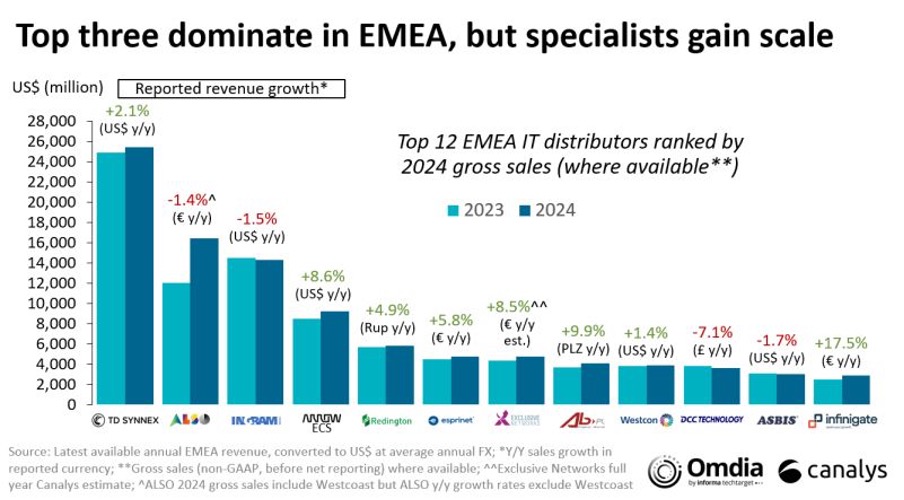

Infinigate’s 17.5% top-line bulge tops the growth generated by all of its top 11 distribution peers in EMEA in comparable periods, according to analyst house Canalys (see below).

Infinigate remains the smallest of this distribution dozen, with closest like-for-like peer – Exclusive Networks – posting gross sales of €5.3bn in 2023 (a tally it forecast would grow by 10-12% in 2024).

Despite UK market leader Westcoast’s acquisition by ALSO, TD Synnex remains the region’s largest distributor, Canalys’ figures show.

Infinigate’s tally in the graph below includes sales from APAC, Canalys stressed.

Its APAC growth, via Wavelink, hit 35% during the period, with its MEA business, Starlink, churning out 26% growth. Europe still grew 9% in the period “despite challenging macro-economic conditions”.

“Our MEA and ANZ teams are leading the growth trend we are working to emulate in Europe. We have the talent and potential to build on this growth in close partnership with our channel and vendor partners especially given the projected growth in the cybersecurity market overall,” Schlichtherle stated.

IT distribution across the globe “faces increasing pressure to adapt and transform”, Canalys Chief Analyst Alastair Edwards said in a LinkedIn post.

“Further consolidation is inevitable. But distribution’s critical role in the global supply chain (particularly as hardware recovers), unmatched channel reach and ability to scale will only enhance its importance,” he stated.