With a few exceptions, the 250 firms in Oxygen 250 2026 shunned one-off product sales in favour of higher-margin, predictable recurring services revenues in their latest years.

Product resale continues to bring home the bacon for the larger protagonists.

But outside the market giants, recurring services is often where the action is to be found – with some Oxygen 250 firms retooling their businesses accordingly.

This includes 243rd-ranked LIMA, whose CEO Danny Masters last May told us it has doubled recurring revenues as a percentage of its overall business from around 40% to 80% since he joined in late 2022.

“We made a bet that the market would move much more towards recurring services – more managed services or a mini-outsource. So we went about changing the whole gearing of the business,” he said.

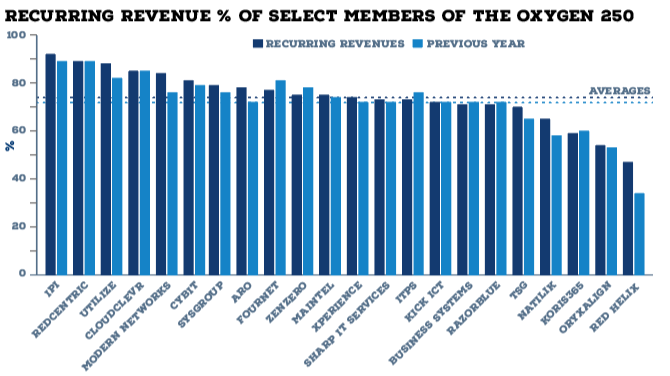

Among the Oxygen 250 firms who broke out the figure across two sets of accounts, average recurring revenue levels rose from 72% to 74% year on year (see below).

250th-ranked Red Helix saw the biggest leap of all in its recurring services mix (the figure rose from 34% to 47%) as its product and services revenues headed in opposite directions in its fiscal 2025.

In many cases, Oxygen 250 firms posted lower sales but higher profits as they continued to sacrifice “empty” one-off product revenues at the altar of profitability.

While 220th-ranked Prolinx’s revenues sank 15% to £18.8m on the back off lower product deals, its gross margins rose by over ten points amid an increase in services revenue.

Similarly, 48th-ranked ARO chalked up a “notable” increase in its gross profit margins (from 46.8% to 48.2%) to its shift towards high-margin, predictable income streams. Its overall revenues dipped 7% to £99.6m.

So pronounced is the resale-to-services transition that some companies in this report now do little or no product.

This includes 131st-ranked IPI, who said the 8% of revenue it generates from non-recurring elements is now entirely professional services driven.

Download Oxygen 250 2026 here.

Visit the Oxygen 250 2026 hub here.