Like breeds of pedigree dogs, the 250 firms in this report have little in common at first glance – ranging as they do from high-end software consultancies to low-margin, high-volume e-tailers.

All, however, act as channel partners for IT manufacturers in the B2B space, reselling their hardware, software and cloud services and/ or providing associated services around their propositions.

A few dedicate themselves to a single brand (with 92nd-ranked Inoapps, for instance, claiming that Oracle “is in our DNA”). Some, like 132nd-ranked aviation specialist ESP Global Services, 239th-ranked legal ace Quiss Technology and 161st-ranked NHS provider Block Solutions have a particular focus on a single vertical market.

“Any vendor looking to boost their penetration of the UK market must consequently first win over these influential and highly skilled guardians of B2B tech spend”

Most, however, would see themselves as vertical agnostic, independent trusted advisors, guiding their SME, enterprise and public sector customers’ technology choices and in some cases acting as their ‘virtual CIO’.

Any vendor looking to boost their penetration of the UK market must consequently first win over these influential and highly skilled guardians of B2B tech spend.

Size-wise, they range from Great Danes such as Computacenter, to Pomeranians with fewer than 20 employees. While the bulk are general enterprise IT providers, many have a focus on specialist areas such as unified comms, networking, cybersecurity, print, AV, cloud or business applications.

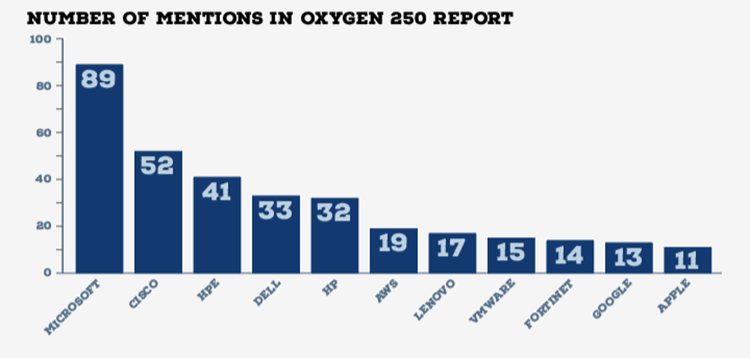

In a sign of its dominance, we have mentioned Microsoft in a whopping 89 of the 250 profiles, ahead of Cisco (52), HPE (41), Dell (33) and HP (32) (see chart below).

While not exhaustive, Oxygen 250 is a fair reflection of the 250 largest revenue-reporting UK IT front-line channel partners on IT Channel Oxygen’s radar.

The headline revenue number in the vast majority of profiles is based on the latest accounts (or in some cases UK accounts) filed by each company on Companies House (as of 12 January 2024). In a few outlying cases, the firms featured have broken out numbers for us, or provided fresher data that supersedes their official audited and filed figures.

In each case, the profile is designed to reflect the size of its UK business (in some cases, however, it was impossible to split out overseas sales with any precision or confidence).

The only question is, who finished top dog (or perhaps, more appropriately, top cat)? Read the report to find out.

Doug Woodburn is editor of IT Channel Oxygen