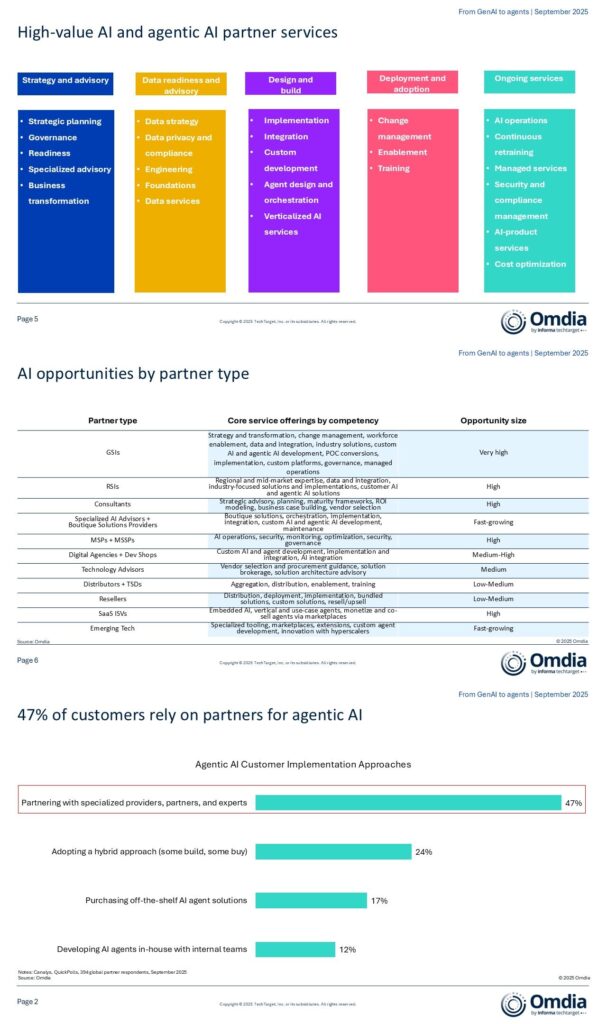

The AI opportunity size for resellers and distributors will lag behind other partner types, according to Canalys.

In its ‘From GenAI to agents’ report, the Omdia-owned analyst outlines a $267bn global partner services opportunity around AI.

Resellers and distributors won’t be the main beneficiaries, however, with Canalys rating their AI opportunity size as “low to medium”.

That compares with the “very high” AI opportunity size facing global systems integrators (GSIs), and ‘high’ rating dished out to consultants, MSPs and MSSPs.

An AI role for resellers

The $267bn AI services opportunity is growing at 35.3% CAGR, “making it one of the largest partner opportunities in the next 3-5 years timeframe”, Canalys Chief Analyst Jay McBain wrote in a LinkedIn post (see bottom).

But not all partner types will profit equally, with Canalys assessing the opportunity for both resellers and distributors/technology service distributors (TSDs) as “low to medium”.

The AI opportunity for distributors and TSDs will centre on aggregation, distribution, enablement and training, Canalys said.

Resellers’ role will be around distribution, deployment, implementation, bundled solutions, custom solutions, resell/upsell, it added, meanwhile.

Ginormous GSI opportunity

GSIs have the largest AI opportunity of any partner type, according to Canalys.

Their AI sweet spots will encompass strategy and transformation, change management, workforce enablement, data and integration, industry solutions, customer AI and agentic A development, POC conversions, implementation, customer platforms, governance and managed operations.

This is despite the CEO of one of the world’s largest GSIs, Accenture, admitting last week that the firm is “exiting” staff who it can’t reskill for the AI era.

“Our clients cannot possibly build all of the expertise they need on their own, they need us to go first and fast,” Julie Sweet said on an earnings call as she revealed Accenture’s number of AI and data professionals has risen from 40,000 in 2023 to 77,000 today.

MSPs and MSSPs are among the other partner types set to profit handsomely from the AI boom. Their AI stomping ground will cover AI operations, security, monitoring optimisation, security and governance, Canalys said.

Some 47% of customers rely on partners for agentic AI, according to the report, which was lead authored by Canalys Principal Analyst Lisa Lawson.

“Agentic AI is evolving as a partner-delivered service; the partners that lean in will capture long-term relevance and value, and those that wait risk marginalisation in an increasingly agent-driven market,” McBain wrote.