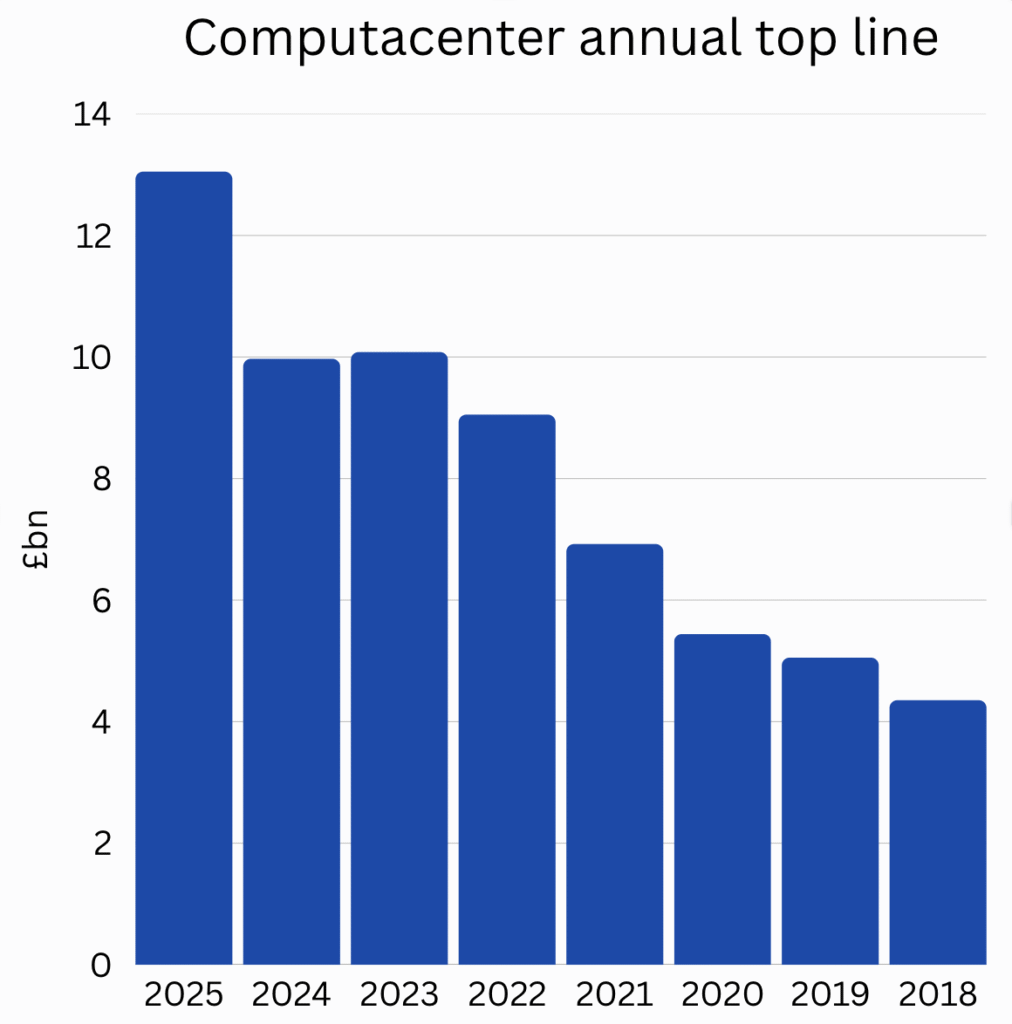

Computacenter’s 2025 top line exceeded £13bn, the LSE-listed giant hinted this morning as it toasted a “strong” second half.

After suffering a blip in growth in 2024, the reseller and services giant indicated 2025 gross invoiced income (GII) came in 31% ahead of the previous year’s £9.97bn tally.

That would imply a figure of around £13.05bn.

It also implies growth accelerated between its first and second half (from around 25% to 36%).

In its trading update, Computacenter said it was “particularly pleased” with its execution in North America, a region it bolstered earlier this month with its $120m acquisition of AgreeYa.

It also now expects adjusted pre-tax profit to be “no less than” £270m, comfortably ahead of both market expectations and the previous year’s £254m tally.

Computacenter said it achieved “consistently strong growth” throughout the year with both enterprise and hyperscale customers in North America, which is now its largest business.

The UK delivered an “improved performance” during the year, while Germany enjoyed a stronger second half. Its performance in France for most of the year was “disappointing”, however.

Breaking it down by activity, almost all of Computacenter’s 2025 growth came from product rather than services, with ‘Technology Sourcing’ GII up 38% and services up 3% (in constant currencies).

Computacenter’s share price surged 9% on this morning’s news, pushing its market valuation to a record £3.57bn (compared with LSE-listed peer Softcat’s current £2.83bn market value).