AI PCs are the new buzz in town, but how many of these next-generation devices will actually ship this year – and what is an AI-capable PC, exactly?

Alongside Windows 11 refresh, AI PCs are being held up as the saviour of an embattled PC market that shrank double digits in 2023. Proponents claim they will boost user productivity and drive down costs by bringing AI capabilities from the cloud to the client.

But how big will the AI PC market be in 2024?

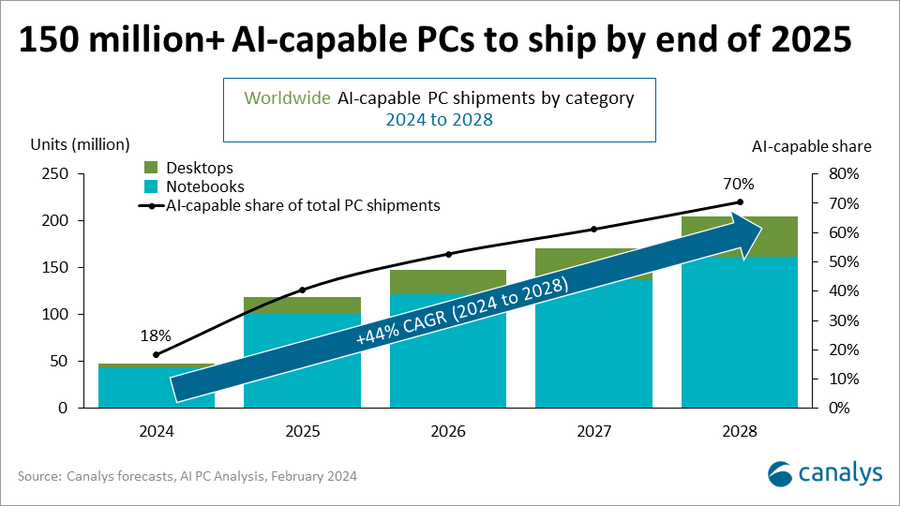

Canalys was the latest analyst to lay its cards on the table this week, estimating that 48 million AI-capable PCs will ship globally in 2024, representing 18% of total PC shipments.

“These PCs, integrating dedicated AI accelerators, such as neural processing units (NPUs), will unlock new capabilities for productivity, personalisation and power efficiency, disrupting the PC market and delivering significant value gains to vendors and their partners,” Canalys said.

This follows predictions from rival analyst house IDC last month that AI PC shipments will hit 50 million in 2024. It defines them as “PCs with specific system-on-a-chip (SoC) capabilities designed to run generative AI tasks locally”. Gartner, meanwhile, expects that number to be 54.5 million.

Talk turning into reality

AI PCs were the talk of the industry as long as six months ago.

Asked to define an AI PC at Canalys Forums EMEA in October, Lenovo IDG President Luca Rossi said there “will probably be several levels of AI PC available to the market”.

“But that is more a 2024-2025 story,” he added.

On that note, IDC has since identified three types of NPU-enabled AI PCs, namely “hardware-enabled AI PCs”, “next-generation AI PCs” and “advanced AI PCs”.

The former will include an NPU offering less than 40 tera operations per second (TOPS) performance, among other things. Qualcomm, Apple, AMD, and Intel are all shipping chips in this category today, it said.

The middle category includes an NPU with 40-60 TOPS performance, and the latter a TOPS of over 60 (no silicon vendors has as yet announced such products, IDC stressed).

Discussing the benefits of AI-enabled PCs at Canalys Forums, Rossi claimed that AI PCs will bring a “dramatic acceleration to productivity”.

They will “learn about you continuously” and “anticipate your needs”, he promised.

“What all of us are trying to do with OpenAI and Bard is now [happening] at the client level, and traditional tasks that were taking two hours will now take two minutes. So it’s going to be massive,” Rossi said.

At the same event, HP CEO Enrique Lores claimed AI PCs will also give users a big advantage around latency and cloud-based vendors an advantage on costs.

“Using AI in the cloud is very expensive. Sometimes you don’t see this cost because it’s paid by the cloud provider, but they are paying for that. Companies like Microsoft, Adobe, Intuit – all of them have a very strong incentive to push the work that is done now in the cloud to the client,” he told Canalys Founder Steve Brazier.

Vendors vying for victory

Six months on, and the top PC vendors are already beginning to jockey for position when it comes to their early AI-enabled devices.

HP unveiled what it claims is the “industry’s largest portfolio of AI PCs” at its Amplify partner summit earlier this month. Most of the devices announced are expected to be available from April.

Also at the start of this month, Dell CFO Yvonne McGill claimed on the vendor’s Q4 earnings call that it has the “broadest portfolio of commercial AI PCs in the industry”.

“While PC demand recovery has pushed out, we remain bullish on the coming PC refresh cycle and the longer-term impact of AI on the PC market,” she said.

The analysts, meanwhile, are predicting that AI-enabled devices will stimulate market growth and raise ASPs.

IDC predicts that AI PC shipments will grow from nearly 50 million units in 2024 to more than 167 million in 2027, by which time they will represent nearly 60% of the market.

Canalys, meanwhile, says that 150 million AI-capable PCs will have been shipped by the end of 2025 (see above).

The 10% to 15% price premium on AI-capable PCs will help boost the overall value of PC shipments from $225bn in 2024 to over $270bn in 2028, Canalys predicts.

“The enhanced capabilities of this new category will create momentum toward premiumisation, particularly in the commercial sector,” Canalys Analyst Kieren Jessop said.