Partner leaders have given a mixed verdict to CyberArk’s potential acquisition by Palo Alto Networks, with one expressing concern over the potential organisational and channel integration challenges it would present.

According to a report yesterday by the Wall Street Journal, Palo Alto Networks is in talks to buy the Israeli privileged access management vendor for over $20bn.

The deal – which the report said could be finalised as soon as later this week – would represent one of the largest tech mergers of 2025 and would rival Google’s planned $32bn acquisition of Wiz in scale.

Update: Since this story was published, later that afternoon Palo Alto Networks confirmed the deal, which is worth $25bn (see here for more).

“Glaring gap”

Talking to IT Channel Oxygen, Guy Golan, CEO of CyberArk partner Performanta, said the acquisition would fill “a glaring gap” in $8bn-revenue cybersecurity market leader Palo Alto Networks’ portfolio.

“They lacked robust identity platform capabilities, particularly in privileged access management, certificate management, and AI-driven identity solutions. Acquiring CyberArk addresses this fundamental weakness.”

Kieron Newsham, Chief Technologist – Cyber Security at Softcat, also applauded the logic of the rumoured deal, which he noted comes after CyberArk in October moved to boost its machine identity capabilities by acquiring Venafi.

“Should this go ahead, PAN would be able to expand its platform into a critical area of identity security that has been missing from its portfolio,” he said.

“This would position them well to address the new challenges introduced by agentic systems, particularly in authentication and authorisation.

“This would not just be an acquisition for today but a strategic move for the near future as well.”

“There was some speculation that Palo Alto might acquire SentinelOne, but given Palo’s existing strength in endpoint security, CyberArk seems to offer a more complementary fit, especially as identity is the new perimeter in hybrid and AI-driven environments,” added Jack Watson, MD of Bytes Software Services, which holds top-tier partner status with both Palo Alto and CyberArk.

“Growing a unified platform through acquisition is a smart move. Even the big companies don’t have time to build every piece from scratch. You need to integrate the best, move fast, and deliver something that just works in AI cybersecurity.”

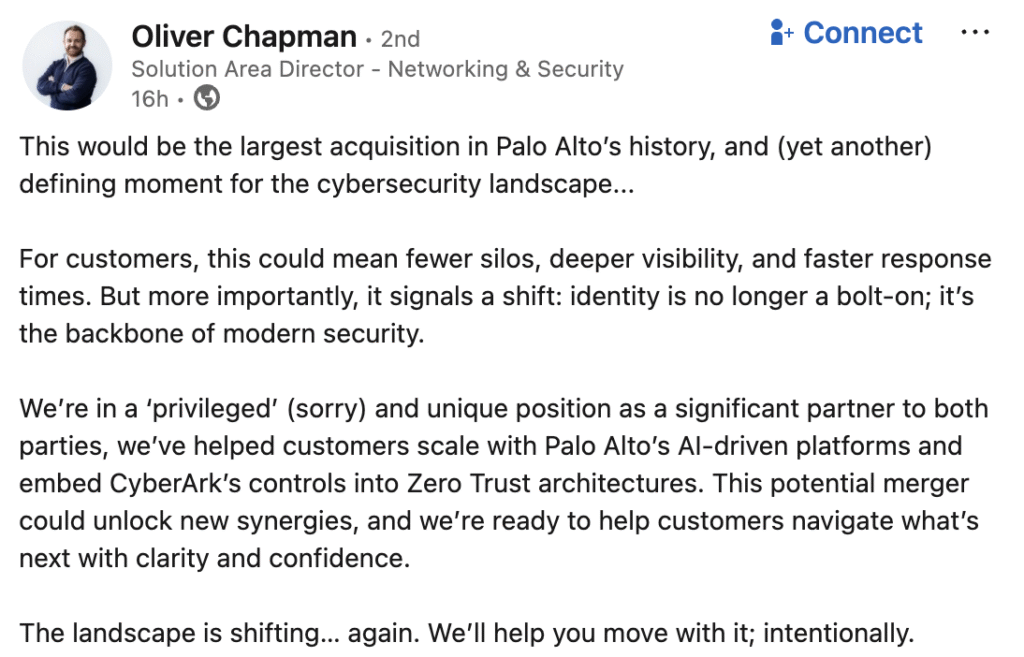

In a LinkedIn post, Oliver Chapman, Solution Area Director – Networking & Security at Computacenter – billed the move as a potential “defining moment for the cybersecurity landscape”.

“For customers, this could mean fewer silos, deeper visibility, and faster response times. But more importantly, it signals a shift: identity is no longer a bolt-on; it’s the backbone of modern security,” he wrote, noting that Computacenter is a “significant partner” of both vendors.

“I anticipate significant integration challenges”

Golan conceded the acquisition “caught him off guard” considering the “aggressive moves” CyberArk had been making to establish itself as the “definitive leader in the identity space”, however.

“Given this momentum and their clear ambition to remain an independent powerhouse, it’s surprising to see them agree to become what will essentially be a feature within Palo Alto’s broader platform,” he said.

Palo Alto will “likely need to address cost structures, as CyberArk is widely perceived as an expensive solution”, Golan added.

The Performanta boss admitted the potential deal “leaves me somewhat conflicted”.

“Palo Alto operates with a fundamentally different culture, and I anticipate significant integration challenges for both the organisation and its partner ecosystem,” he said.

“From a channel perspective, I expect substantial changes in partner engagement models, margin structures, and support frameworks – changes that may not align with the relationship-driven approach that characterized CyberArk partnerships.”

CyberArk brings “significantly more substantive value to the table” than other major deals such as Google’s attempted Wiz acquisition, Golan added, however.

“This acquisition represents a tectonic shift in the cybersecurity landscape that will reshape competitive dynamics and partnership models across the industry,” he said.

“The competitive landscape implications are significant, particularly for Microsoft. This deal gives Palo Alto a substantial advantage over Microsoft, which lacks comprehensive privileged access management capabilities despite having general identity management tools. I expect this will force Microsoft to either pursue their own acquisitions in this space or accelerate development of internal PAM solutions

“It also shows that cybersecurity is in great consolidation mode and will potentially be dominated by three to five players offering holistic cyber to the market.”

Watson said Bytes “anticipates changes to partner programmes when our vendor partners make these big moves, and we’ll be monitoring these developments closely”.

“For now, it’s business as usual across both vendors on a strong growth trajectory. Our teams remain focused on delivering speed, scale, and success using their solutions and our services,” he said.

NASDAQ-listed CyberArk’s revenues grew 43% year on year to $317.6m in Q1.

Its shares vaulted 15% on the Wall Street Journal report, pushing its market value to $21.85bn. This makes it more valuable than long-time identity rival Okta (market value: $17.3bn).

A CyberArk representative told IT Channel Oxygen “we don’t comment on rumours or speculation”, while Palo Alto Networks hadn’t immediately responded to our request for comment at the time of publication.