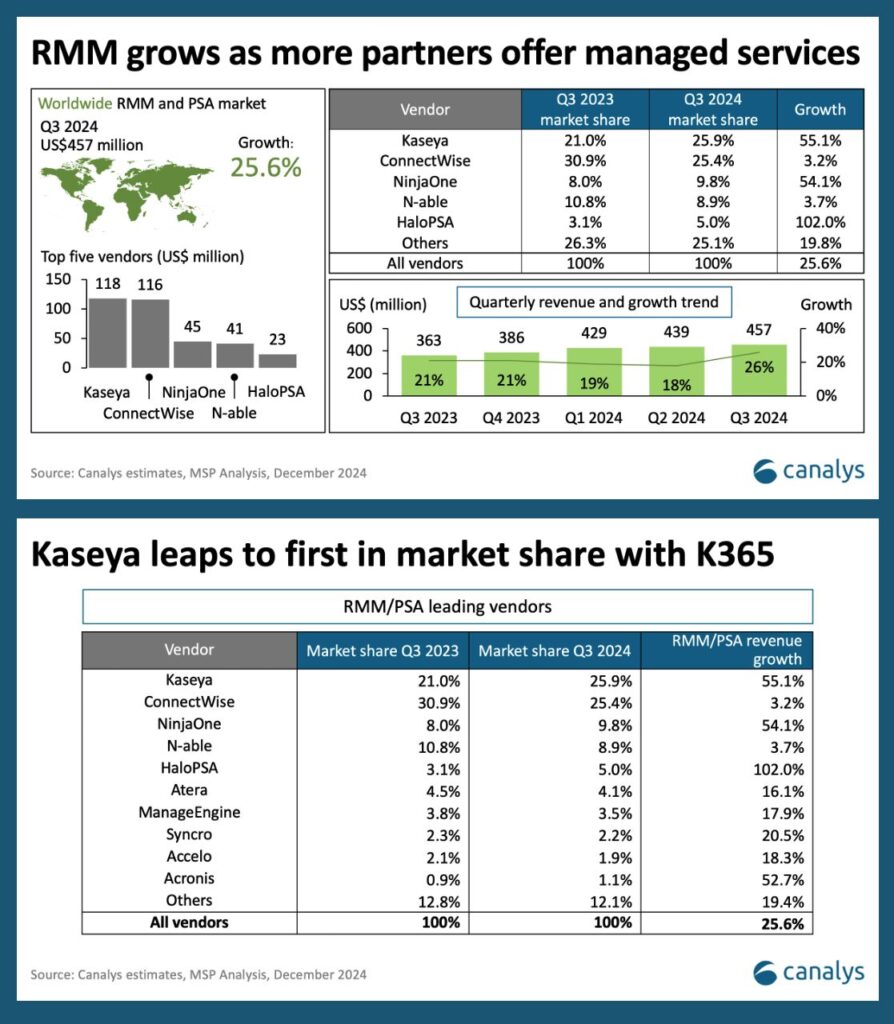

An analyst whose research recently put Kaseya as the new marketshare leader for MSP software is doubtful it can retain the status in 2025, predicting ConnectWise will have a big year.

According to research by Canalys, ConnectWise relinquished top dog status for RMM and PSA software marketshare to Kaseya in Q3 2024.

Kaseya pocketed 25.9% of the global market, edging out Connectwise (25.4%) for the first time since records began.

In other changes, NinjaOne displaced N-able in the bronze medal race on the back of 54% year-on-year growth.

“I don’t think it will hold on”

Talking to IT Channel Oxygen, Canalys Principal Analyst Robin Ody said Kaseya is successfully “seducing” MSPs with its new Kaseya 365 offering as it puts a focus on bundling and “unit economics”. His comments came just as Kaseya CEO Fred Voccola announced he is stepping down as CEO after ten years.

“Kaseya 365 appeals to the channel because a lot of MSPs struggle with profitability – between 20% and 25% of MSPs are regularly not profitable,” he said.

Ody is expecting a big year from ConnectWise, which appointed a new CEO in September in the form of Manny Rivelo, however.

ConnectWise acquired Axcient and SkyKick last September, with Kaseya snapping up SaaS Alerts the following month.

“I don’t think Kaseya will [hold on],” he said.

“ConnectWise needs to do something – it needs to shift. But I think we’ll hear a lot from ConnectWise in 2025, from a cybersecurity and platform standpoint.

“ConnectWise changed CEO. It’s very possible they’re trying to get towards an IPO position.”

“A slightly better year”

Ody said he expects the global managed services market to grow about 13% in 2025, up from 11% in 2024.

“We’ll see a slightly better year this year,” he said.

Fast-growing RMM vendors such as NinjaOne and HaloPSA will face big questions over their ownership in 2025, Ody predicted, meanwhile.

“HaloPSA said it wouldn’t sell itself. NinjaOne is presumably a very strong target for a lot of people, but does it want to sell? It probably doesn’t right now, but IPO and M&A is going to be a pretty big part of the year.”

Doug Woodburn is editor of IT Channel Oxygen