Softcat can be unveiled as the UK’s largest IT reseller in the inaugural edition of Oxygen 250, which was compiled in partnership with Nebula Global Services.

Founded in 1993 by Peter Kelly, the Marlow-based outfit is the largest of five billion-plus outfits featured in the report, which examines the fortunes of the largest 250 resellers, MSPs and niche consultancies on IT Channel Oxygen’s radar.

Together, these 250 firms turned over £26.8bn in their latest years on record, a 17.8% jump on the previous year. Any vendor looking to boost their penetration of the UK market must consequently first win over these influential and highly skilled guardians of B2B tech spend.

Head to the Oxygen 250 hub for the full report.

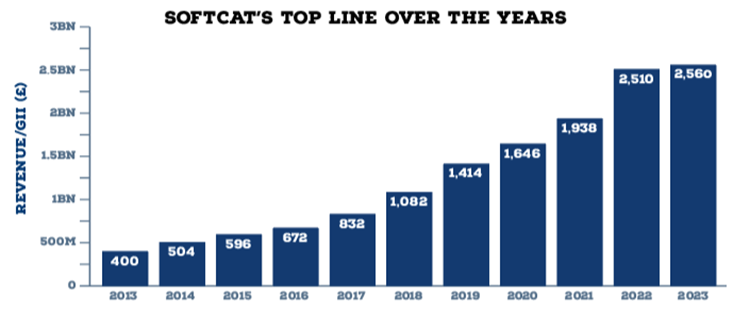

While Computacenter remains comfortably the largest UK-headquartered reseller/services business (thanks to its overseas prowess), Softcat powered past Computacenter in terms of UK revenue around three years ago. It remains a close contest, however: Softcat’s gross invoiced income hit £2.56bn in its year to 31 July 2023, compared with Computacenter’s calendar 2022 UK GII of £2.32bn.

In his annual results statement, newly crowned CEO Graham Charlton characterised it as “another record year” for the LSE-listed IT infrastructure specialist, whose headcount swelled by 20.5% to 2,315 during the period.

Softcat made good on its mission of selling deeper into existing customers during the year, with average gross profit per customer swelling 12.2% to £37,000. Its customer base expanded by 1.9% to 10,100, meanwhile.

Gross profit – Softcat’s primary measure of income – leapt by 14.2%.

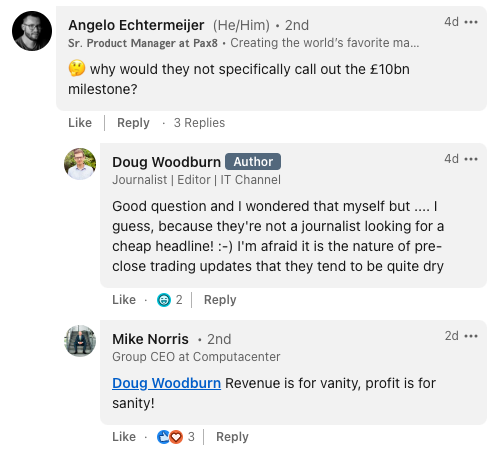

To what extent do the likes of Softcat and Computacenter really care who is number one?

Judging from Charlton’s comments at the bottom – as well as those of Computacenter CEO Mike Norris directly below (made in response to an IT Channel Oxygen story flagging up the fact that Computacenter appears to have broken £10bn GII in 2023, but didn’t explicitly acknowledge it), neither are overly bothered.

In any case, Oxygen 250’s largest protagonists continue to outgrow the wider market. The largest 10 firms in Oxygen 250 hit revenues of £12.5bn in their latest year, representing 46.6% of the report total (up from a 46.1% share a year previously).

The wider top 100 – who all turn over at least £53m – saw their collective top line advance 18.6% to £22.6bn in their latest years on record, compared with the 13.7% growth logged by those placed from 101-250. That meant they accounted for 84.3% of the top 250 total.

Citing Gartner numbers pegging its addressable market at £60bn, Softcat estimated its marketshare at around 4.3%.

“Something that has really characterised our success is a challenger mentality – being anti corporate, not doing what everyone else is doing, thinking for ourselves, not moving with the crowd,” Graham Charlton told IT Channel Oxygen following his appointment in August.

“As you hit number one and other people are now shooting at you, maintaining that challenger mentality is a bit more difficult. But it’s something I’m determined we will absolutely maintain.”

IT Channel Oxygen sat down with Softcat CEO Graham Charlton following the publication of its fiscal 2023 results in October

What’s your message to the market around these results and how they should be seen?

It was another year of strong growth that was ahead of the expectations we set coming into the year.

Our primary measure of income, gross profit, grew double digits in both halves. Growth was broad-based across all the customer segments and different areas of technology.

We increased headcount in line with our plans – up 20%. We’re really delighted with the levels of recruitment but also the levels of retention we are seeing, which has played into that strong growth. So we’re entering the new year in a terrific position with good momentum.

You mentioned that headcount during your FY2023 rose 20%. At what rate will you increase headcount in 2024?

We’ll keep investing and keep growing it, but it will be at a slower rate. We had really strong recruitment and retention last year, and that puts us in a great position. But we’ve usually targeted headcount growth in the 10-15% range, and that will be the case again in the year ahead.

What are your investment priorities for the year ahead?

To keep expanding our proposition for customers in the way the market is moving. So that means focusing on hybrid cloud, cyber security and AI capabilities, but also maintaining our traditional capabilities as well.

And then investing in, modernising and seeking the value from our own systems and data capabilities. We’ve put a new financial system in and new data, storage and governance. That gives us lots of opportunity to embrace new ways of working and putting AI to work in our own operation.

Looking at Computacenter’s UK gross invoiced income in its fiscal first-half of 2023 (£1.27bn), it’s almost exactly half that of Softcat’s full-year 2023 GII. In other words, the ‘contest’ to be the UK’s largest VAR/services business is getting interesting again. Does this dynamic mean anything to you at all?

No not really. Like you say, it’s a point of interest, but we’ve never run our business for gross income, and we won’t do that either.

Computacenter is a terrific business, whether that’s in the UK or outside of it, so it’s lovely if we can be seen to be outperforming them. But they’re only 3% of the market and we’re only 4% or 5% of the market; so getting distracted by a competitor’s gross invoiced income number really doesn’t interest us. We’d rather keep selling the right things to customers when they need them and making a margin and a return on that. Genuinely, I don’t get distracted by that.