Analysis of the geographic positioning of the UK’s top 250 IT solutions providers throws the UK channel’s southern bias into sharp relief.

Just over half (126) of the 250 VARs, MSPs and IT consultancies featured in IT Channel Oxygen’s flagship Oxygen 250 report have their HQ (or UK HQ in the case of international players) in either London or the South East.

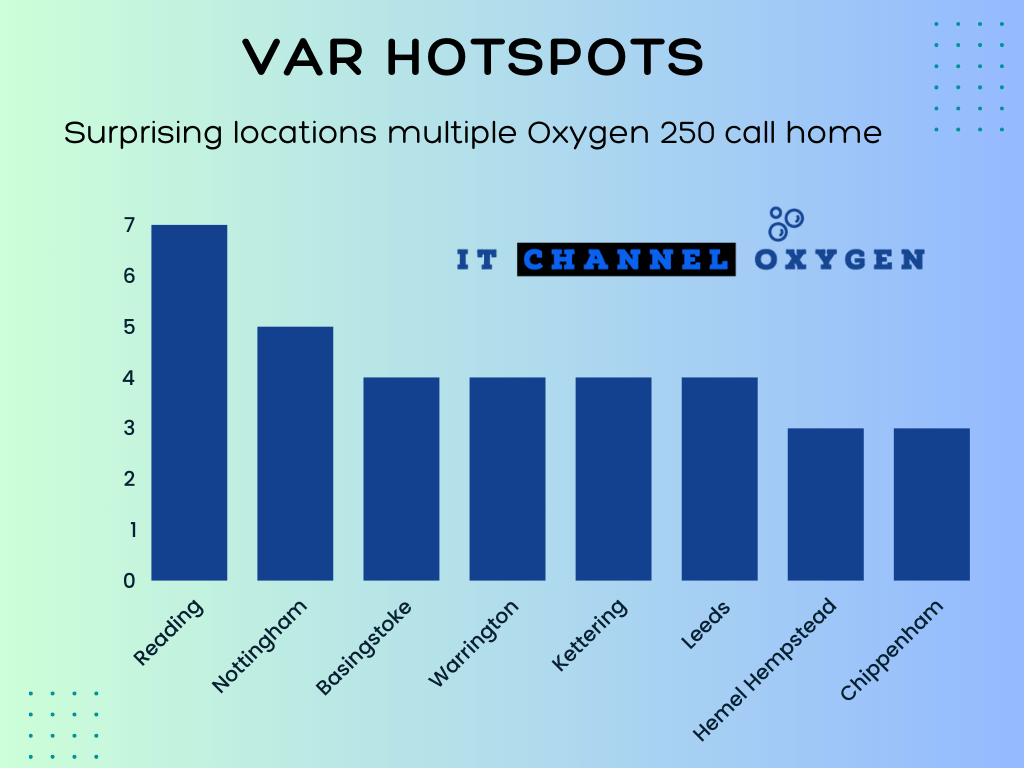

Despite this, the Midlands, East of England, South West and North West serve up several alternative VAR hotspots.

Home is where the VAR is

Compiled in partnership with Nebula Global Services, Oxygen 250 charts the fortunes of the top 250 UK IT channel partners on our radar, as well as the trends impacting their business.

These 250 firms generated sales of £26.8bn in their latest years on record, making them a powerful front line sitting between vendors and the end-user budgets they are eager to unlock.

Their total headcount rose 14.7% to 72,888, meanwhile.

But where do they call home?

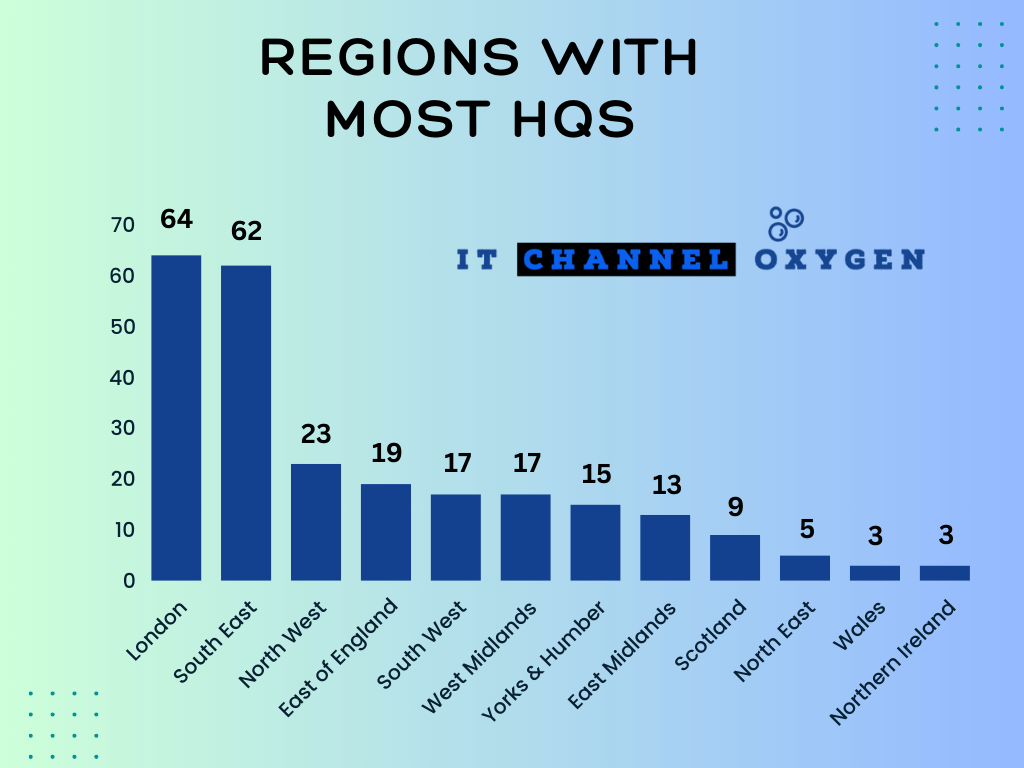

Critics who complain that the UK IT channel is too skewed towards the south of the country will find little to contradict them in our figures.

As our wage analysis shows, London is way ahead when it comes to the average salaries these elite firms pay.

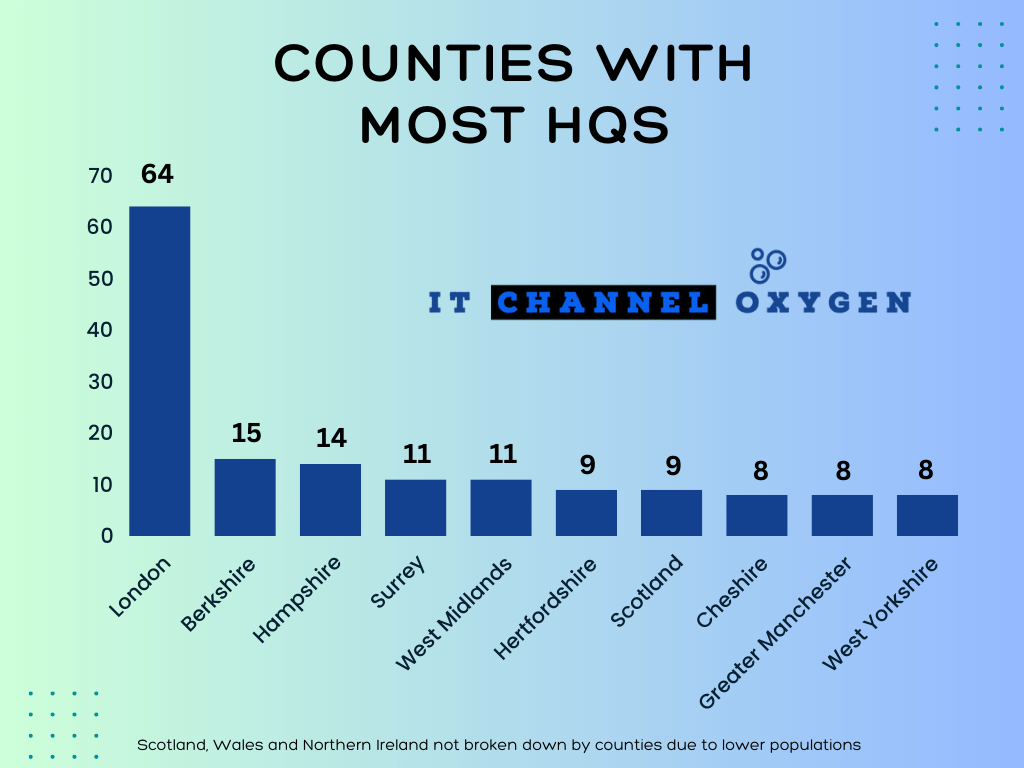

And it is also the backdrop for a disproportionality high 64 Oxygen 250 HQs, including many of the reports biggest players (including CDW, WWT, Avanade and Sabio).

The wider South East region hosts a further 62 HQs, with the tech-centric M4 corridor and Berkshire in particular acting as a VAR honeypot.

Outside of these two regions, HQs are fairly evenly dotted around the country, with the exception of the less populous regions/countries of the North East (five firms), Wales (three) and Northern Ireland (three).

While the top four counties for Oxygen 250 HQs are all in the South East, the West Midlands, Cheshire, Greater Manchester and West Yorkshire emerge as notable alternative hotspots.

Several counties, including Cornwall and (perhaps more surprisingly) Leicestershire, host no Oxygen 250 firms at all.

Haunts and hangouts

While York is sometimes cited as a small city that hosts a disproportionately high tally of resellers, it is often a location for satellite offices rather than HQs (with MTI the latest to set up an outpost in Yorkshire’s county town last month).

Despite having a population of just 173,000, Reading is the setting for seven Oxygen 250 HQs. Basingstoke – a town favoured by some of the big distributors – hosts five Oxygen 250 firms.

Hemel Hempstead is called ‘mi casa’ by three Oxygen 250 companies in the shape of CAE, Annodata and Koris365, while Warrington is the HQ location for 4 (Tactus, Datel, CloudCoCo and Involve Visual Collaboration).

Head to the Oxygen 250 hub for more.

Doug Woodburn is editor of IT Channel Oxygen