Several of VMware’s UK partners have revealed what they would like to see happen following the closure of its $61bn takeover.

Semiconductor and infrastructure software giant Broadcom today confirmed that it has finally completed its 18-month quest to acquire VMware, after China gave clearance for the deal.

In a blog post, Broadcom CEO Hok Tan billed it as a “new and exciting era” for the company. VMware will reportedly now operate as four divisions within Broadcom, namely VMware Cloud Foundation, Tanzu, Software-Defined Edge and Application Networking and Security.

Broadcom and VMware – which boast annual revenues of $35.5bn and $13.6bn, respectively – “can now come together and have the scale to help global enterprises address their complex IT infrastructure challenges by enabling private and hybrid cloud environments and helping them deploy an ‘apps anywhere’ strategy,” Tan asserted.

Tan also reiterated previous claims that Broadcom will “invest significantly” each year to advance VMware’s innovation. Half of this investment will go into R&D, with the other half used for helping accelerate the deployment of solutions through VMware and partner professional services, he claimed.

“We are committed to creating value and driving revenue for our robust partner ecosystem, which has been made stronger with the addition of VMware’s partner,” Tan added.

From the off, the identity of VMware’s acquirer has ruffled feathers in the partner base.

In the wake of the deal’s closure, IT Channel Oxygen got snap reactions from several UK partners.

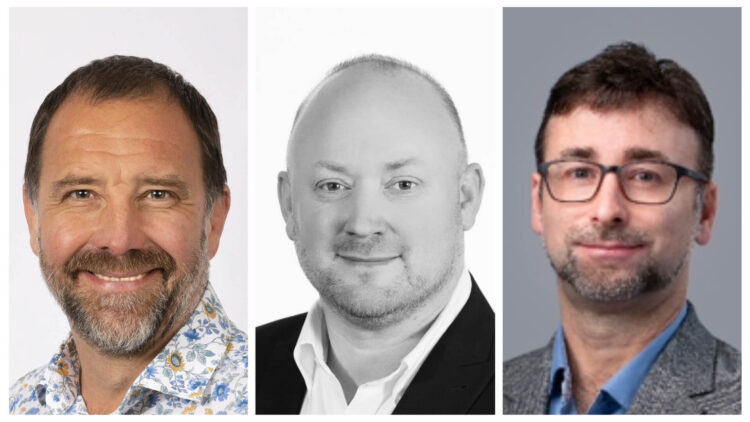

Gavin Jolliffe, CEO of Xtravirt

VMware credentials: VMware Principal partner

Wishlist includes: Clarity over the VMware portfolio roadmap; ability for customers to pay in line with use and adoption; greater simplicity across the portfolio including fewer product SKUs and ease of pricing

What would you like to see from Broadcom?

We look forward to receiving further clarity over the VMware portfolio roadmap. As Broadcom deliver on their promise to invest across the VMware datacentre and multi-cloud portfolio, we expect to see customers being given greater flexibility, with the ability to pay in line with use and adoption.

We hope to see the commitment to drive simplicity across the portfolio result in fewer product SKUs and pricing to be more easily understood by customers, making it easier for them to transact with VMware and operate their solutions.

What’s your reaction to the deal closing?

We’re pleased to see this period of uncertainty come to an end. We look forward to seeing Broadcom’s statements of intent coming to fruition with increasing clarity about how these objectives will be achieved.

Today marks the start of a new era which we believe will bring new opportunities and relevance to VMware customers across their datacentre and multi-cloud strategies.

Neil Roberts, CEO of Concorde Technology Group

VMware credentials: Multiple customers with £1m-revenue-plus VMware estates

Wishlist: A more modern partner ecosystem and greater focus on smaller customers

What would you like to see from Broadcom?

It would be for VMware to be a bit more connected and to have a better partner ecosystem – one that’s more modern.

Also, one of the things VMware has been guilty of in the past ten years is only being interested at an enterprise level. We’ve got some clients that have £1m renewals, which VMware are tripping over themselves to help with. But getting any support at a lower level has always been difficult.

Does it worry you that Broadcom has previously said it wants to focus on the top VMware accounts?

That’s also something VMware has done themselves over the past ten years. If you look at the marketshare Microsoft has taken with Hyper V, they’ve just let it happen.

What’s your reaction to the deal closing?

I’m just pleased it’s over the line one way or the other because at least we can get on with processing renewals and looking at future sales.

Richard Blanford, CEO of Fordway Solutions

VMware credentials: VMware underpins 10-15% of its revenues

Wishlist: Using VMware to create a public cloud competitor; pricing drops

What would you like to see from Broadcom?

My actual wish is quite a weird one, but it would be for Broadcom to do something interesting and combine it with some silicon to make a suitable public cloud or publicly accessible cloud platform that can rival the hyperscalers. I don’t think that’s going to happen. But I always thought VMware missed an opportunity at the start of public cloud.

VMware are less relevant to most partners these days. Cloud repatriation is the possible space they could work in, but I don’t see that being huge. They’ve got a good legacy business that I’m sure generates reasonable returns, and probably doesn’t need an awful lot of investment from Broadcom.

Is there anything else you’d lobby the new owners for?

VMware has always been pretty pricey for what it does. When it started seeing competition in the mid 2010s, particularly from Hyper V, the value proposition was hard to state. VMware has a good slice of a large and not-that-fast diminishing on-premises marketplace. Anything Broadcom can do to encourage maintenance and new opportunities in that market will give them would give them traction.

Does Broadcom’s M&A track record concern you?

It would if VMware was really important to us, but it’s not. Back in the early 2010s, roughly 70% of our customers were VMware based. Now, we’re a public cloud-focused organisation and most of our work involves taking workloads off VMware and sticking them into Azure and AWS. VMware is probably now a factor in 10-15% of our revenues, and we only see that shrinking.

Andy Trevor, Owner, Cutter Project

VMware credentials: Independent specialist in VDI and virtualisation

What do you make of the initial noises that have come out following the deal’s closure, particularly the news that VMware will operate as four divisions within Broadcom?

As VDI specialists, we have looked at the four new divisions announced with an interested eye. No mention of EUC – we shall be following this quite closely.

What do you think will happen now?

There has been plenty of time for the rumour mill to ramp up to full speed. I think in truth, there is very little any of us know for certain. I suspect pricing will rise and the drive to get everyone on subscription will increase. Outside of that, I think we have to wait and see. I do know that the customer base is nervous of what will come from this.

Doug Woodburn is editor of IT Channel Oxygen