The managed services market was thrown into the spotlight last week when the government released a major study of the sector.

Managed services makes a “significant economic contribution to the UK economy”, the study stressed. It estimated that there are 11,492 MSPs in the UK who together generate £52.7bn in managed services revenues.

The study had two main objectives, namely to size the MSP market and to understand the potential impacts of bringing MSPs into scope of the Network and Information Systems (NIS) regulations – which are designed to keep digital supply chains secure.

It estimated that between 1,500 – 1,700 large and medium MSPs could potentially be impacted by NIS. Some 3,182 small and 6,623 micro MSPs would not come under its scope as they would be exempt, it added.

But the study threw up as many questions as it did answers.

So was it a hit or miss with the sector itself?

We harvested the views of five MSP experts and market watchers.

“It’s a bit iffy, but it’s important they’ve done something”

Paul Lloyd, MSP Expert and Founder of Sellerly

What does the decision to commission a study of this nature say about the MSP sector?

The fact they’ve done it suggests it’s becoming an increasingly important part of the economy.

But I think it also highlights the fact that technology is appearing in the news a lot. Obviously we’ve had the whole Post Office business, and there’s always something around security appearing in the press. Up until relatively recently, it muddled around the background. I think these cock-ups have brought it to the forefront.

But it’s also a growing sector. There are significant businesses in the channel, when you look at Computacenter and Softcat – even Bytes is now doing over £1bn. They are serious businesses. So it’s a combination of the sheer size of the market, plus the challenges the likes of the Post Office have had, that has brought a spotlight on it.

What did you make of the findings, particularly the fact it seemed to take such a wide view of managed services?

If there was a mistake, that’s exactly it.

If you look at your [Oxygen] 250, the 250th firm is doing £15.7m, so there’s a massive difference between one and 250. Once you drop below that, I’ve always worked on the premise that there are around 12,000 businesses, and the study’s numbers bear that out.

We came up with a definition a few years back that said [for a company to be an MSP], 60-70% of its business has to come from services, but also that their business model is a monthly recurring model, as opposed to chunks of change. If you do that, you’re an MSP, and there aren’t many companies like that that grow beyond £5m revenue.

When you get down to that £1m-£2m-revenue space, that’s really the MSP space – 25-30-people support businesses, for local businesses.

You wouldn’t include Tata and the major consultancies as MSPs.

In that respect, you could argue the report is a bit iffy, but the important thing is they’ve done something.

“We do diverge on a few key points”

Robin Ody, Principal Analyst, Canalys

What does a study like this say about the MSP market?

I think it’s great the UK government is trying to get a handle on the IT managed services market. As the leading global channels-focused analyst firm, we have been tracking managed services at the country level for several years, and we deliver this data to the world’s biggest IT vendors on a regular basis.

Do you particularly agree or disagree with any of the study’s findings?

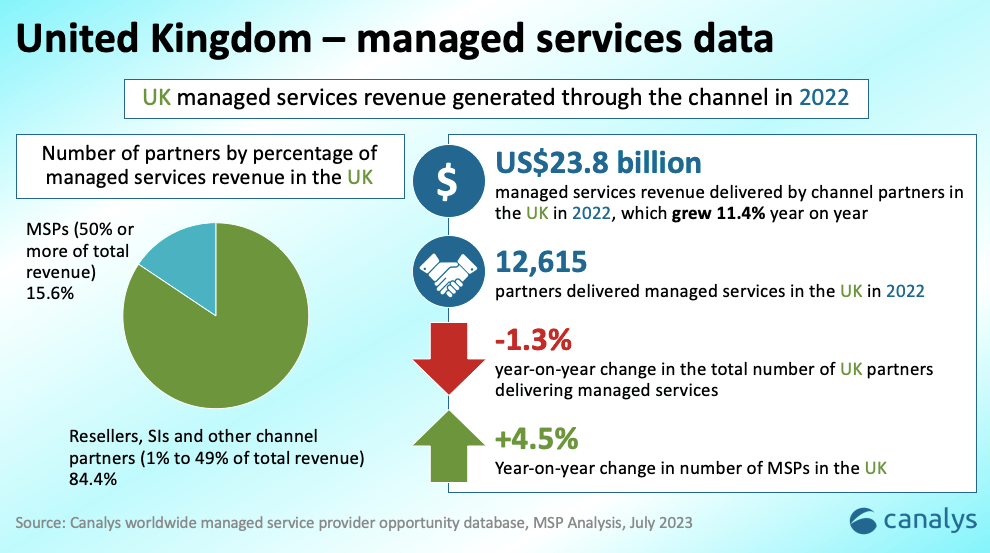

Our estimates (see below) show that while we don’t seem to differ much on the total number of channel partners delivering managed services in the UK, we do diverge on a few key points.

Canalys defines an MSP as a channel partner which makes more than 50% of its revenue from managed services. In the UK, there are only 1,970 of these companies by the latest annual count, though there are 12,615 partners delivering managed services. In essence, 24.3% of the UK’s managed services revenue is generated by MSPs, while the rest is delivered by a mix of resellers, SIs and other channel partners.

Our total revenue figure is also quite different, at US$23.8bn. We do not count direct (vendor to customer) managed services data in this.

“It shines a torch on the sector, and means it’s being noticed and recognised”

Dave Tulip, Managing Director of The Network Group

How did you greet the publication of this study?

I think it should be welcomed. It shines a torch on the sector, and it means it’s being noticed and recognised.

Our feeling [at the Network Group] is that the standards need to rise in the marketplace.

You, Doug, can become an MSP today. You just set yourself up in your bedroom. It doesn’t make you one, but you’re calling yourself one.

We welcome improvements in standards.

The Network Group is for small- to medium-sized MSPs – our average size is 18 staff, £2m revenues, managing 2,500 endpoints. And we have approaching 90 of them in the UK. Most of those are going to fall below where the [NIS] regulations come in.

The government suggests there won’t be a two-tier market, but there’s no doubt if I was with an organisation that falls into the NIS regulation I may just sow doubts about dealing with those that are smaller in size. That doesn’t make them any less competent, but they won’t have the tick in the box to suggest it.

So we’re working on a charter with a view to setting the bar ourselves at a higher level.

What message would you have for the people who commissioned the report who are now acting on its findings?

My message would be to engage with the frameworks, experts and organisations that are out there a bit more closely, as there’s a lot of goodness happening.

There’s already a thriving community of networking available. Whether that be rocking up Comptia, participating in Tech Tribe, or as you go up the food chain things like Evolve from ConnectWise and other peer groups. There’s already lots of sharing that takes place.

“It highlights that IT services are, and will be in the future, delivered by partners”

Dom Black, Director – Research at Cavell Group

What does the government’s decision to commission a really big report on MSPs say about the sector?

The UK government – and I’m lumping Ofcom into this – have been pretty off the boil in terms analysis and understanding of what’s going on.

For them to commission this, without a huge view behind why they’ve done it, is really interesting, and really highlights that IT services are, and will be in the future, delivered by partners.

There’s always a fear when we’re speaking to [partners] about ‘are some of the vendors going to cut us out?’ I really don’t see that. My view is more and more is going through the channel and that the channel is by far the most important thing to get right – and probably the thing most people get wrong.

Was there anything in the findings that surprised you or that you particularly disagreed with?

It said the largest MSPs account for 74% of the estimated total revenues. Those kind of numbers really worry me. I think it’s underestimating the size of smaller providers and the impact they have on the market. When we do research around it, the small businesses tell us they want to buy from a local provider and want that local touch. Saying 4% of the firms account for 74% of total estimated revenues is all well and good, but actually there’s still a huge market for smaller MSPs to grow.

We’ve been building something similar to [the study] for a while. We have a global database of around 85,000 IT and channel partners, which we aim to segment by what vendors they have in their portfolio and what services they are selling. We’ve got some cool data harvesting going out on all those websites. In the UK, we only track around 5,000 or 6,000 channel partners. So for the 11,000 providers they’re talking about, we’re not probably picking up all those micro providers.

“The way we traditionally define managed services is changing”

Richard Tubb, MSP expert, host of TubbTalk and founder of Tubblog

What does the decision to commission a study of this nature say about the MSP sector?

“The way we traditionally define managed services is changing, and rapidly. MSPs should be prepared for new legislation, as many organisations categorise various IT services companies as ‘managed services’. The growing popularity of AI will make it more important to have legislation that targets managed services businesses, too”.

Doug Woodburn is editor of IT Channel Oxygen