Computacenter has just closed the most profitable half in its history – but indicated its 2024 top line will dip below £10bn.

Following a 10.3% first-half sales dip, the LSE-listed giant enjoyed a “stronger” performance in the second half of the year, it indicated in a pre-close trading update this morning.

Technology sourcing gross invoiced income (GII) is set to power up 13% year on year in the period, with services revenues up 5%.

Despite this, the reseller and services giant acknowledged it will not quite match its £10.08bn 2023 GII haul, at least on a reported basis.

On a reported basis, GII is set to fall 2% (which would put it somewhere between £9.83bn and £9.93bn). In constant currencies, the figure was actually up 0.5%.

“While we are pleased with overall execution towards the end of the year, with Germany and North America delivering strong performances, parts of our larger current technology sourcing projects in the US and the UK have slipped into the early part of 2025,” Computacenter stated.

Peaking profits

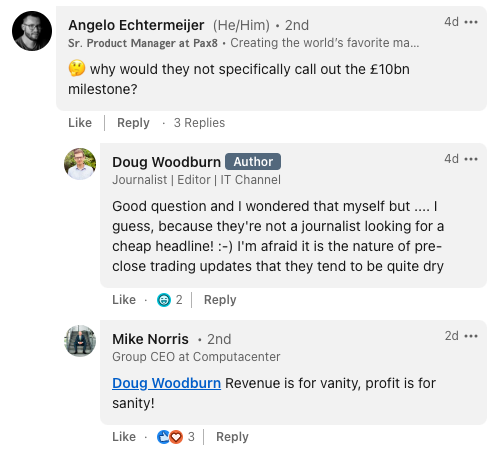

As Mike Norris – who this month marked 30 years as Computacenter CEO – has made abundantly clear, it is profits, rather than sales, that motivates him.

Computacenter branded the six months to 31 December 2024 the “most profitable half year” in its history, stressing that it ended the period with a record number of customers generating over £1m of gross profit per annum.

For the full year, adjusted profit before tax is set to be at the low end of analyst forecasts ranging from £253.6m to £266.5m (compared with £278m in 2023), however.

That’s partly down to ongoing group-wide investments, the completion of its share buyback and a £7m adverse translation impact from the stronger pound.

Computacenter – which ranked third in Oxygen 250 2025 – said it entered 2025 with a committed product order backlog “significantly ahead” of the previous year, as well as June 2024.

“Looking to 2025 as a whole, we are mindful of the uncertain macroeconomic and political environments in some of the European countries in which we operate,” it stated.

“In the UK, rises in [national insurance] from April are expected to have an adverse impact of c.£5m in 2025. In North America, following a strong performance in 2024, we continue to be excited by the growth opportunities we see ahead.”