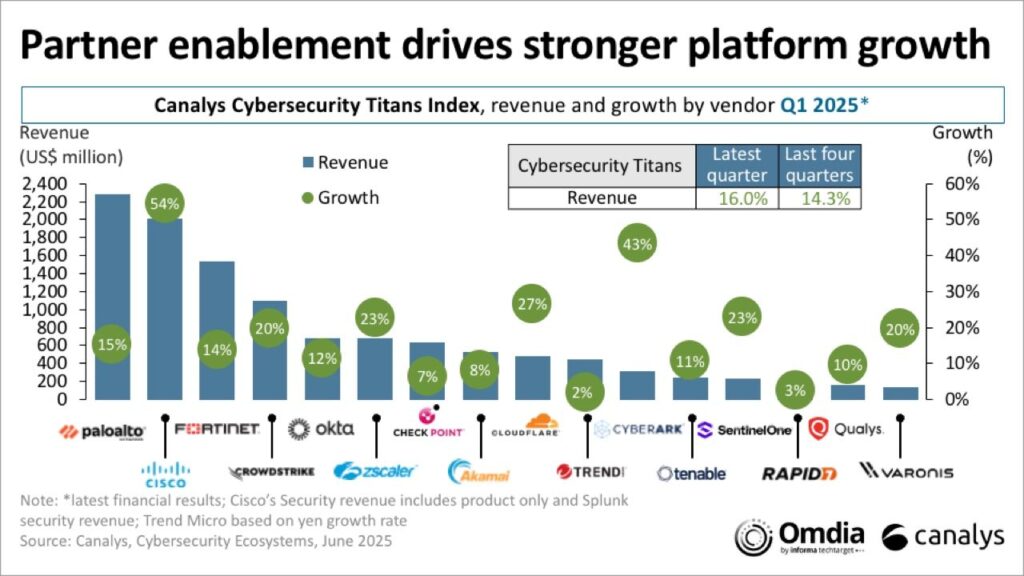

The world’s largest publicly listed cybersecurity vendors saw their collective growth accelerate to 16% in Q1 – thanks partly to heightened platform adoption.

That’s according to analyst house Canalys, whose quarterly research benchmarks the performance of 16 publicly traded ‘Cybersecurity Titans’, each with annual revenue of over $300m.

Led by Palo Alto Networks, they grew revenues 16% year-on-year in the first quarter, above last quarter’s high-end forecast of 14.6% (and beating Q4 and Q3 2024’s respective 12.8% and 14.8% growth tallies).

It was the highest revenue growth since Q4 2023, Canalys said.

Top dog Palo Alto Networks grew revenues 15% to $2.3bn in its most recent quarter (ended 30 April 2025) as it “continued to make progress” on its “platformisation strategy”, CEO Nikesh Arora said.

This was a pattern mirrored across the 16 Titans, as larger deals – boosted by platform adoption – elevated their numbers, Canalys said.

Fourth-ranked CrowdStrike – whose Chief Business Officer recently told IT Channel Oxygen that last summer’s CrowdStrike-induced Windows meltdown “made us a stronger company” – saw revenues hike by a fifth to $1.1bn in its latest quarter ended 30 April 2025.

The recent wave of retail cyberattacks have “brought even more urgency to security conversations”, one onlooker present at last week’s Infosecurity Europe show in London said. Human layer security emerged as another key theme.

Following the “strong start” to 2025, Canalys said it has raised both short- and long-term cyber revenue forecasts slightly from March.

To be considered, Canalys’ Cybersecurity Titans must have annual revenue of over $300m, have been publicly trading for at least four quarters, and to break out their cybersecurity revenue numbers quarterly.

The 16 vendors fitting this description are: Akamai Technologies, Check Point Software, Cisco (including Splunk), Cloudflare, CrowdStrike, CyberArk, Fortinet, Varonis, Okta, Palo Alto Networks, Qualys, Rapid7, SentinelOne, Tenable, Trend Micro and Zscaler.