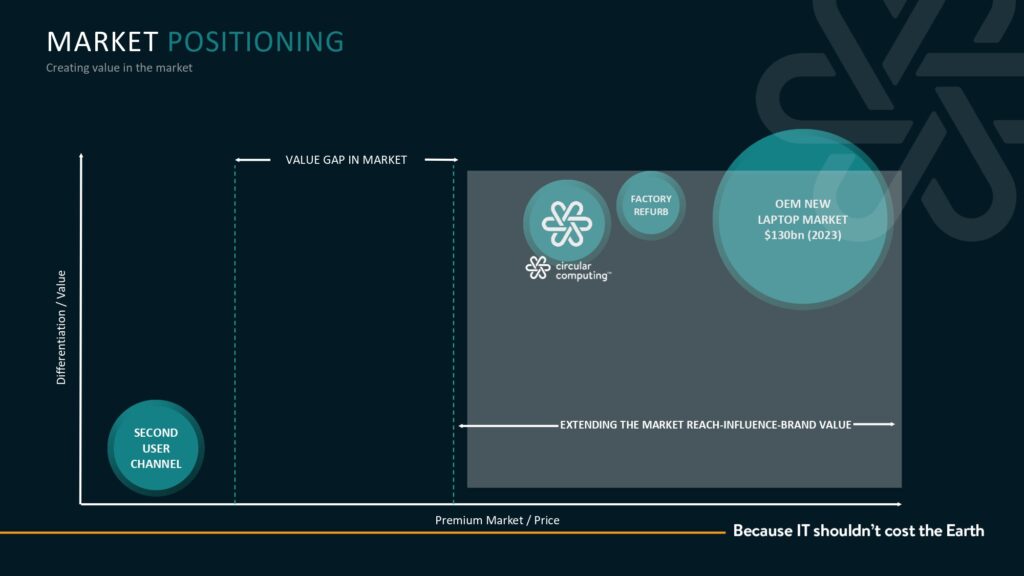

Circular Computing claims it has identified a gap in the market between new and refurbished for its remanufactured laptops.

The UK-based outfit, which recently bagged a monster Irish public sector framework win, rebuilds laptops to an “as-new” standard from a factory in the Middle East (pictured top).

It works through several of the UK’s largest VARs, as well as around 20 smaller MSPs, via distribution partner Ingram Micro.

Talking to IT Channel Oxygen for our Second Life Hub, Circular Computing Group Director of Sustainability Steve Haskew predicted that the UK IT channel will see a “big burst” in demand for second-user IT in 2025 as devices purchased during the first lockdown reach end of life.

“I think 2025 is really going to flush out massive opportunity for sustainable IT and I hope we are right in the eye of that,” he said, despite adding that the “financial plumbing” of the channel is currently geared more towards selling new.

One potential threat looms for Circular Computing in the shape of the big OEMs themselves, who are said to be looking at developing their own flavour of remanufactured.

What is remanufactured?

One of Circular Computing’s key challenges is educating the market on the differences between refurbished and remanufactured, Haskew said.

Circular Computing remanufacturers Dell Latitude, HP Elitebooks and Lenovo Thinkpads to an “as-new” standard and with an “as-new or better-than-as-new” warranty, Haskew explained.

This means that remanufactured laptops have a shot at displacing a portion of the first-life market, Haskew said, adding that they typically come in 30-40% cheaper than new.

This separates them from their refurbished counterparts, which – despite being cheaper still – aren’t of interest to large swathes of the market, he claimed.

“To all intents and purposes, what the customer gets [with remanufactured] is a brand-new product. It’s just that we can’t call it ‘new’. We have to call it ‘remanufactured’ because we’re not the original manufacturer,” he said.

“There is a market for refurbished. But it’s not within those customers that buy new today, otherwise they would be buying refurbished today.”

One potential hazard for Circular Computing comes in the form of the OEMs themselves. HP, Dell and Lenovo are all thought to be eager to develop a remanufactured proposition themselves that would come with their own warranty, which some partners feel will appeal more to enterprise customers (see more, bottom).

BSI kitemark

Having built its UAE factory in 2015-16, Circular Computing’s product quality “wasn’t where it needed to be” for the first few years when it was field testing the product, Haskew admitted.

Then in 2021, Circular Computing secured a British Standards Institute kitemark, guaranteeing that its laptops will perform at least as well as equivalent brand-new models.

“Remanufactured is the process of taking apart the laptop right down to the component level – testing, replacing and remanufacturing the component technology and then bringing it back together, like an Airfix kit,” Haskew explained.

“The chassis is repainted completely. The keyboard is reprinted. The trackpad is also repainted. The screen is remanufactured so there are no white spots.”

“There are other organisations calling their product ‘remanufactured’, but there’s only one that can say they have the kitemark from the BSI for remanufactured laptops, and that’s Circular Computing,” Haskew added.

“We want other people to get it, so there’s a competitive environment, but it’s a difficult thing to own and very costly. We are audited every six months, at a significant cost, but our customers are demanding of that.”

Customer success

In the UK, Circular Computing has had its biggest successes to date with local authorities and NHS trusts.

But on the back of its big Irish win, it now has its sights set on an EU public sector market worth up to €500m, Haskew said.

That’s based on it repeating its feat of biting out a 12% of the Irish PC market in every EU country, he explained.

The drivers for adoption aren’t necessarily technological but, rather, political, he explained.

“In the financial team, we save 30-40%, and that’s great. But from a ministerial level, we help them achieve evidence that they’re achieving their green procurement agenda, and there are financial runoffs for the country to do so,” Haskew said.

“If you have an organisation that has a net zero target, we can definitely help them do that. They can point at their stakeholders and say ‘look, even the IT team is moving the needle in the right direction, we’re saving money, and we’re not being compromised in operations’. That’s a win at multiple levels.”

While refurbished devices are a good fit for school 1:1 device projects, or for companies ordering one, five or ten laptops at a time, they are not a viable option for large corporate rollouts, Haskew claimed.

“We often hear customers saying ‘well what about quantity, and consistency of SKU?,” he said.

“All of the things an as-new product offers, that’s what remanufactured offers, and we’re able to do that at scale, which is also important.

“We were talking to a FTSE company yesterday who had 45,000 units in their estate. They don’t want six of this and half a dozen of the other. They want consistency and quality in supply, the same as they would get from the manufacturer.”

UK demand

Despite the inclusion of Sustainability and Circular IT in the recent TePAS 2 framework, Haskew previously said Crown Commercial Service “hasn’t really got its head around the various states of second user”.

But he is holding onto hope that the UK could follow in Ireland’s footsteps.

“I’m quite interested to see how the next administration gets involved, because I think the 30-40% saving is a compelling story, if you talked about, let’s say, the NHS,” Haskew said.

“They’ve maybe got a million laptops. You might save £300 or £400 a device, which is a significant amount of money to plough back into the public sector.

“You’re procuring in a fashion that is resourceful, but also presses down heavily on the green agenda. So it fixes more than one thing.”

Vendor tension

Haskew said Circular Computing needs A-brand PC vendors to continue building “brilliant” first-life products for it to remanufacture in three to five years’ time.

But these OEMs have a complex relationship with reused IT, Haskew said, stressing that they need to cater to rising demand for sustainable IT while defending their traditional ‘new’ territory.

“In Ireland, we’ve taken 12% of the public sector market away from the OEMs’ brand-new product, and so we’re starting to see them respond accordingly,” he said.

“In Northern Europe, where customers are demanding sustainable IT in large quantities, the OEMs are now addressing it in probably the most appropriate way, which is saying ‘if we could put a warranty on the product, would that help the customer? Can we get consistency of supply, and if we can, where is that product coming from? Can we get comfortable with the quality of that product’?

“Because, ultimately, they have a brand reputation to maintain. If HP was to put a second-life product into the market, and it was a bad experience, not only might the customer not go back to HP for second user, they might just move to Dell for brand new.”

Because they outsource manufacturing of the product to ODMs, OEMs find remanufacturing “very difficult”, hence why Circular Computing is collaborating with some of them to “get them moving into sustainable IT”, Haskew said.

Making money from remanufactured

The OEMs’ “financial plumbing” is heavily geared towards selling new, Haskew said, however.

“The OEM requires refresh to maintain hardware sales, so it lubricates the channel financially to make sure those things happen,” he said.

“It’s trillions of dollars’ worth, and that needs a little bit of protection and thinking about.

“But the customers are demanding more, and I think the channel has recognised that it needs to try and protect what it’s got while transitioning across. We have to get to the new way, because there’s not enough stuff in the ground and ultimately making stuff in the production factories is 31% of greenhouse gas emissions globally.”

Can the channel make money from selling remanufactured or indeed refurbished IT?

“I think it can, but there’s going to be a bit of disruption along the way,” Haskew responded, conceding that partners who push too quickly may struggle to hit vendor sales quotas on new equipment.

“If someone is selling a £1,000 new laptop and making a 5% profit, that’s the same as selling a £500 remanufactured one and making 10% profit. But it depends on the resellers’ drivers. They may want super-great revenue and not care as much about profits, in which case a cheaper solution isn’t beneficial,” he said.

“But, ultimately, it comes down to what the customer wants. Otherwise they’ll lose their customer, and I think they’re waking up to that.”

Reseller reaction

Partners we spoke to gave a mixed verdict on whether Circular Computing could gain traction in their customer base, with one (who did not wish to be quoted) concerned that customers will gravitate more towards OEMs’ remanufactured offerings if and when they are perfected.

“Circular Computing’s story is credible, but – although they give a warranty – they don’t give a manufacturer’s warranty. My belief is that the kind of customers we’re dealing with at an enterprise level will want an OEM’s warranty on a second-user remanufactured device, rather than something that’s coming in from a specialist remanufactured offering,” they told us.

“We’re aware HP, Dell and Lenovo are all trying to develop that as an offering in terms of taking in what could be grade C technology and bringing that back up to a remanufactured state through a process.

“I can see that getting some real traction in time. But it’s still very early days. They’re all trialling it out. Sourcing the equipment to allow them to get enough volume through that is still proving to be a bit of a challenge.”

Alex Groves, Head of Sustainability at SCC, said that, although the Birmingham-based reseller currently only offers refurbished rather than remanufactured PCs, “that’s’ definitely something we want to be offering customers”.

“There are definitely customers where having a warranty means something,” he said.

John Gladstone, Softcat Sustainability Lead John Gladstone hailed Circular Computing as the current gold standard for remanufactured, meanwhile.

“Circular Computing are doing a fantastic job of innovating that latest and greatest in terms of what remanufactured looks like,” he said.

“Remanufactured is like taking a BMW back to BMW, stripping it down and making it like a brand new car. It’s got miles on it, but you’d never know the difference between that and a new car.

“With the refurb piece there are still visible signs.

“I think all the vendors are wanting to remanufacture to that Circular Computing standard, and I think that will become the de-facto standard going forward. Remanufactured will be what customers adopt first, as they will have the trust and backing of the vendors. Refurb will be a middle ground.”

Gladstone added: “The opportunity is very clear, especially if you look at what the French government has done with the requirement to use remanufactured equipment within their procurement practices.

“We can see that happening in public sector and we can see that happening in private sector as well. Companies aren’t going to reduce their emissions from a procurement aspect unless they actually start using more remanufactured and refurbished goods.

“I don’t think it’s going to be 100% of the market. I think it’s probably going to sit on 20% to 30% going forward.”

Doug Woodburn is editor of IT Channel Oxygen