When Bristol-based outfit Kascade recently rebranded from Computerworld to reflect its “profound transformation” from reseller to MSP, the 235th-ranked outfit was only mirroring the experiences of a large cross-section of the Oxygen 250.

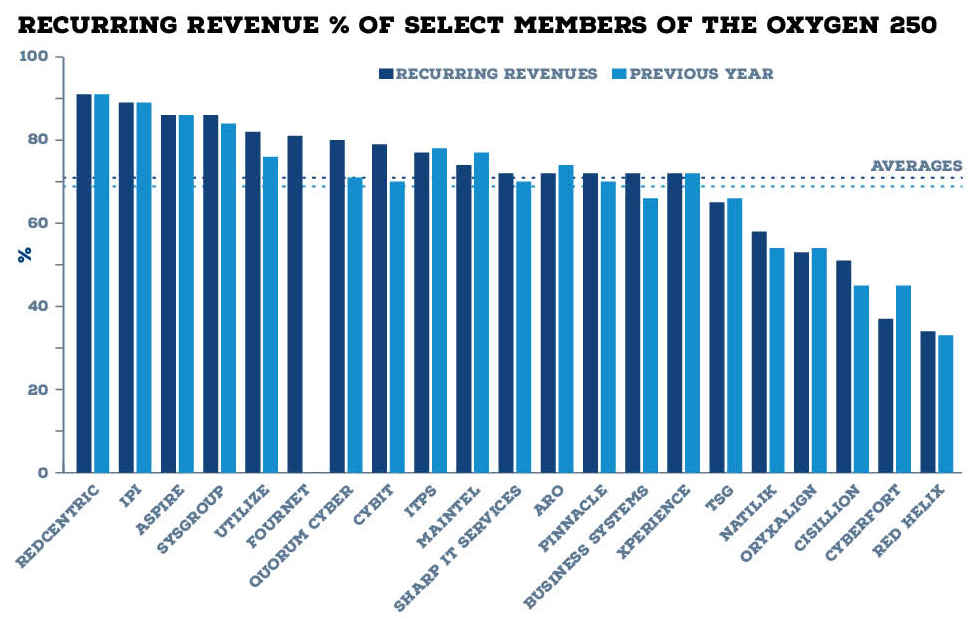

Countless firms in the report spent their latest annual periods sacrificing one-off product sales at the altar of higher-margin services and recurring revenues, partly in a reaction to a systemic slowdown in the hardware market.

At Canalys Channels Forum EMEA in October, Canalys founder Steve Brazier urged the assembled partners to focus on software and services as he called time on three decades of hardware growth for the channel.

“[For the last 30 years] you sat there, you waited for new hardware products to launch… and you followed that growth as those categories grew year after year after year,” he said. “Unfortunately, we are calling a turning point today in that 30 years, which is essentially – across the board – the hardware industry is no longer growing.”

Giving hardware the heave-ho

That sentiment was echoed in the latest results from across the Oxygen 250, from the £1bn-plus market giants to the £15m-£30m-revenue outfits that tail the rankings.

This includes 9th-ranked Insight, who to the delight of Wall Street has spent the last 18 months snapping up software and services firms as it recasts itself as a ‘solutions integrator’. Services rose to 20% of net sales in its latest quarter (compared with 14% two years previously). And the strategy has arguably paid off, with net earnings defying an 8% net sales slump by growing 12% to $213m in the first nine months of 2024).

231-ranked Lima Networks best summarised the mood among this report’s smaller players when it characterised its calendar 2023 as “challenging”, as the rise of SaaS dented the need for the on-premises hardware it specialises in. Efforts to respond by moving from a one-off sales to a recurring multi-year model (services rose from 25% to 36% of revenues in its latest year) have caused short-term pain, it acknowledged, however.

159th-ranked AMC IT was another to open up on its efforts to embrace services as hardware sales dried up. In an effort to “future proof” its business, it launched a new entity, AMC-IT Services, in its fiscal 2024. “AMC hopes to take advantage of the higher demand for cloud-based solutions and professional services which should compensate for expected decreases in physical hardware and warranty sales,” it said. “Switching to more contracted revenue will enable the directors to plan for the future with greater certainty.”

The new normal?

There were some exceptions to the rule, as a few companies in this report (including 154th-ranked Koris365, 195th-ranked Medhurst, 161st-ranked VCG and54th-ranked Maintel) enjoyed a spike in hardware sales in their latest years as they unwound product order backlogs from the previous year. 26th-ranked Advania acquired two large reseller businesses in 2024 in the shape of 15th-ranked CCS Media and 148th-ranked Servium, meanwhile.

But in his Canalys keynote, Brazier said the hardware market is unlikely to grow for at least three years, “unless we invent a new magical category”.

So is slow or no hardware growth the new normal?

Mark Marron, CEO of global networking reseller ePlus (the parent company of 61st-ranked IGX Global), certainly thinks so. ePlus’ latest quarter results – showing net sales dipping 12% YoY to $515m in the three months to 30 September 2024 – “reflect the ongoing evolution of the industry towards rateable and subscription revenue models and slower product sales”, he said.