The big continue to get bigger in a cybersecurity market now worth over $20bn a quarter.

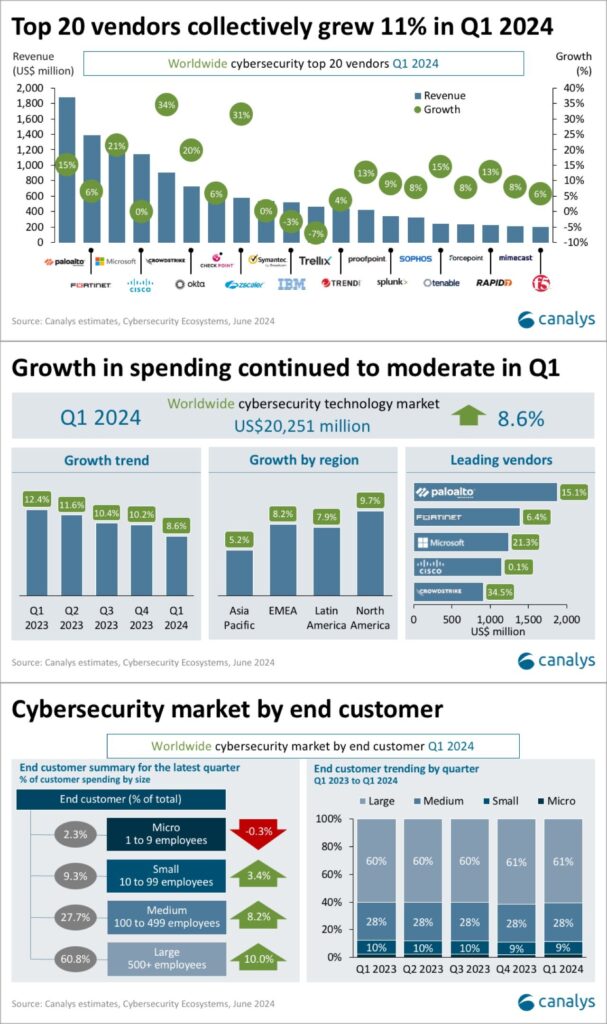

That’s according to Canalys, whose latest research shows the top 20 cybersecurity vendors swelling their collective marketshare from 61.7% to 63% in Q1 and market leader Palo Alto Networks further tightening its grip.

While the overall cybersecurity market advanced 8.6% to hit $20.3bn in the first three months of the year, the combined sales of the top 20 players vaulted 10.8%, the analyst said.

Cybersecurity has never been far from the headlines in 2024, with this month’s crippling ransomware attack on the NHS making the front pages and rekindling the debate on whether ransoms should be paid.

More IT solutions providers are buying or building cyber practices to help clients fortify their defences.

But even the cybersecurity market is seeing decelerating growth, however, with the Q1 uplift down slightly on the 10.2% rise recorded in Q4.

Market leader Palo Alto tightened its grip on the space during the quarter, growing its share of the spoils from 8.7% to 9.3% year on year thanks to blistering 15.1% growth. This put it ahead of Fortinet, Microsoft and Cisco.

Fifth-placed Crowdstrike – which this week became the fastest cybersecurity company in history to be added to the S&P 500 index – also lit up the market with 34.5% growth, propelling its marketshare to 4.5%.

Canalys is tipping growth to accelerate to 10.6% in the second half, leading to 9.7% growth across the year as a whole.

“The worldwide cybersecurity technology market grew 11% in 2023 and we are forecasting spending will grow 10% in 2024,” Canalys Chief Analyst Matthew Ball said.

“After a slower start in Q1, we expect growth rates will pick up again in H2. The slowdown in spending growth in recent quarters can be attributed to three main factors.

“First, macroeconomic uncertainty and customers scrutinising budgets, even for mission-critical areas like cybersecurity. Second, difficult year-on-year comparisons because of the impact of firewall backlog release in 2022 and early 2023.

“Third, strong USD impacting vendor growth, especially in Asia Pacific. In H2, we expect the very early stages of a new firewall refresh cycle to contribute to stronger growth in addition to continued investment in identity and cloud security, and SecOps modernising, as well as budget releases for delayed cyber projects over the last few quarters.

“Threat levels remain heightened. Customers cannot keep putting off investment in enhancing their cyber resilience. “