The UK’s top 250 UK resellers and MSPs between them employ nearly 73,000 staff, and pay them an average wage of £57,000.

That’s according to analysis of headcount and wage data among the 250 firms featured in the recent Oxygen 250.

Produced in partnership with Nebula Global Services, Oxygen 250 profiles the largest front-line channel partners on our radar by revenue, from £2bn-plus giants Computacenter and Softcat to niche providers with £16m revenues.

IT Channel Oxygen members can download the report for free here.

Pecuniary probe

How many staff do they employ, and how much are they paid?

That’s a question IT Channel Oxygen can at least partially answer after rifling through 250 sets of accounts for the report.

We noted down the total wage bill and average monthly headcount of each (or, at least, the 242 on which we could locate the data), dividing the first by the second to obtain a mean pay figure.

The mean of those means (or ‘double average’), stands at £57,013.

Two competing mega-trends would have had contrasting impacts on pay levels during the periods under review (which were most commonly for the years ending 31 December 2022 and 31 March 2023).

While spiralling UK inflation turned the heat up on wages, the tech downturn that began in late 2022 may have had a commensurate cooling effect.

It’s therefore no great surprise that average wages grew, but nowhere near as fast as inflation – at 3.6%.

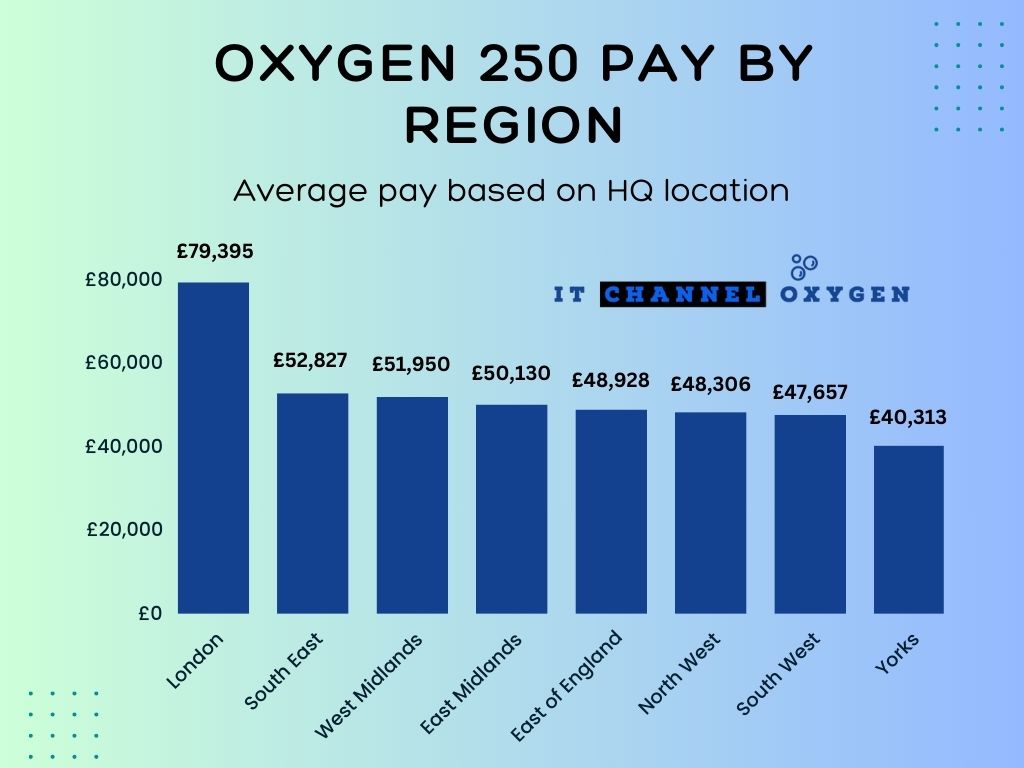

Pay levels increased much more rapidly in London than elsewhere in the UK.

The average wage of Oxygen 250 firms headquartered in the capital stood at £79,395, a 7.8% rise year on year.

After London, you could throw a blanket over the other English regions in terms of average pay levels, with the notable exception of Yorkshire & The Humber (see above). We haven’t included figures for the North East, Northern Ireland, Wales or Scotland, due to a lack of data.

Pay levels rose across all but two regions, namely the South East (average wages down 1.2% to £52,827) and the North West (average wages down 5.9% to £48,306).

Looking at their total headcount, the top 250 employed 72,888 staff between them in their latest years, a rise of 9,193 (or 14.7%). Somewhat intriguingly, that is below the 17.8% revenue growth they recorded, suggesting they were able to do more with commensurately less resource.

Although much of the headcount uplift would have been due to the artificial boost of M&A, at least some of the Oxygen 250 have been on an organic hiring spree. Take cybersecurity services powerhouse Bridewell, which grew its headcount from an average of 29 in 2020 to 191 by the end of 2022.

The number of staff employed by the Oxygen 250 is roughly equivalent to the population of Canary Wharf.

While MSP and reseller pay levels may not quite match those of the East London urban hub, these figures demonstrate that the channel remains a (well-paid and growing) industry.

Doug Woodburn is editor of IT Channel Oxygen