NVIDIA has become the world’s most valuable company, but will it power on to the $5tn mark, or suffer a fate similar to Cisco – which briefly achieved the same status in 2000?

That’s the debate on everyone’s lips this morning after the AI chip giant whizzed past Microsoft to go top of the market cap tree (with a $3.34tn valuation).

NVIDIA’s rise has been meteoric. Its shares have doubled in 2024 and swelled by more than 3,000% over the last five years amid an AI goldrush.

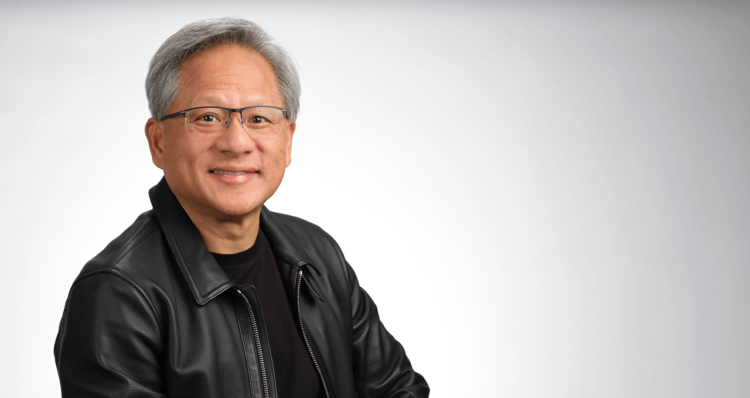

Its leather jacket-sporting CEO, Jensen Huang, has become the compulsory wingman at any vendor event (popping up only this week at HPE Discover to endorse the vendor’s new private cloud AI offering), meanwhile.

“My personal view is that NVIDIA are overvalued”

Talking to IT Channel Oxygen, renowned analyst Steve Brazier, said there is a “risk” that NVIDIA could suffer the same fate as Cisco, however. The networking giant briefly became the world’s most valuable company in 2000 before the dotcom crash wiped almost nine-tenths off its shares.

“The time Cisco rose in the late 1990s just before the dotcom crash is a decent parallel,” Brazier, the former Canalys CEO who now goes by the title of Informer Fellow, said.

“Cisco was – and is – a very important company, but it got hugely overvalued. It’s not yet got back to where it was 24 years ago.

“So that’s the risk with NVIDIA.

“They’re a phenomenally successful company. They have by far the best AI chips. AMD and Intel are trying to catch them up – AMD is closer. But they’re still behind and in this goldrush you don’t want to be running on second-tier processors; you want to be running on the top ones, which is NVIDIA.

“My personal view is that NVIDIA is one of the most important companies in the world, but they are now overvalued because at some point supply will meet demand. The market will become more competitive, not in the next 12 months but certainly within three years.”

“How foolish that was”

NVIDIA’s phenomenal rise closely tracks the emergence of genAI, which Brazier said “has convinced the vast majority of investors we’re in a new industrial revolution”.

Some investors believe NVIDIA is now in a race with Apple and Microsoft to hit the $4tn valuation mark.

This includes boxxe CEO and tech investor Phil Doye, who is backing NVIDIA to rise even higher after ruing his decision to sell his own NVIDIA stock.

“In 2016 I went to San Francisco with Bloomberg and some investors and we went to NVIDIA and met Jensen Huang,” Doye told IT Channel Oxygen.

“He told us not to invest in anything else other than NVIDIA … it was by far the best stock we could buy. I did buy $100k but sold when I had trebled my money … how foolish that was.”

The new “kingmaker”

Brazier agreed that NVIDIA is a “phenomenal story”, pointing out that Huang can play “kingmaker” when it comes to the success of Dell, HPE and Lenovo.

Huang – who has been branded the ‘Taylor Swift of tech’ – appeared to stick his neck out for the former in March when he urged attendees of the GTC AI conference to “call Dell” (see below).

“The real question for [HPE CEO] Antonio Neri yesterday with the launch of on-premise or managed services LLMs is ‘they’re great, but can you deliver them’?,” Brazier said.

“NVIDIA has the power to determine who wins and loses by their allocations. Microsoft, Meta and Amazon have the biggest control over buying and everyone else comes later down the chain.”

NVIDIA’s rise is drawing a new battle line between on-prem infrastructure vendors such as HPE, Dell and Lenovo and the hyperscalers, Brazier noted, meanwhile.

“When the public cloud came along I was astonished that so many companies were willing to outsource their data to the public cloud providers without what seemed like any concern for the risks they were taking in terms of their core assets being held by someone else,” he said.

“It will be interesting to see whether with AI and LLMs the corporates are more cautious, or whether they’ll just give it to the big three clouds without thinking about it.

“Certainly HPE, Dell and Lenovo will be singing from the rooftops that ‘we should own control of this because the risks are too great’ – but with public cloud that message didn’t go too well.

“Let’s see how it goes with the next generation.”

Doug Woodburn is editor of IT Channel Oxygen