This feature appeared in Oxygen 250 2025. IT Channel Oxygen members can download the full report here (membership is free).

The 250 firms in Oxygen 250 are more than just a channel to market for vendors, with many now viewing their own services and IP as the cornerstone of their success.

Despite this, all sell and add services around the technology of a chosen vendor, or – more commonly – multiple vendors.

And more often than not, one vendor in particular is in the mix in the shape of Microsoft.

When Computacenter CEO Mike Norris told an audience of channel pros in September that “none of us would be here without what Microsoft did for the industry”, he wasn’t overstating the software giant’s impact on our industry.

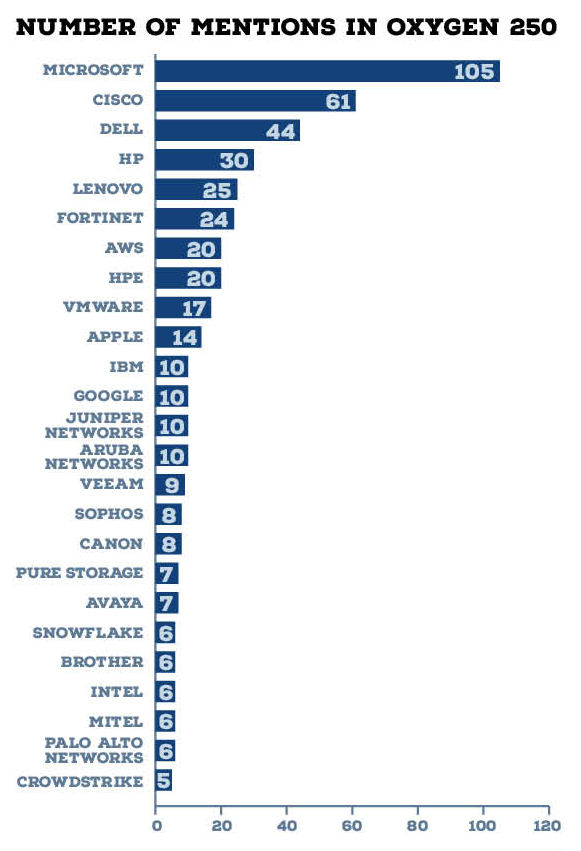

We mentioned Microsoft in 105 of the 250 profiles, equal to the combined number of mentions of second-placed Cisco (61) and third-placed Dell (44).

Even though the hardware market is in freefall, the channel has benefitted from the continued buoyancy of its most powerful ally. While not immune to the tech downturn, Microsoft it grew revenues 16% to $109bn in its fiscal 2024.

In a sign of the Oxygen 250’s diversity, some 94 vendors were name-checked in at least two profiles, however.

Mainstream IT vendors such as HPE, HP, Lenovo, Fortinet and AWS all came up at least 20 times.

From the world of print, Brother was mentioned 8 times. Comms vendors such as Avaya (7 mentions), Mitel (6 mentions), 8×8 and Genesys (5 mentions each) cropped up regularly, as did audio-visual specialists including Poly and Crestron (5 mentions each). Business applications and enterprise software vendors such as SAP (7 mentions), Sage and Oracle (5 mentions apiece) and Autodesk (4 mentions) also rang out loudly.