“Lead times are now stretching beyond 100 days in some cases”

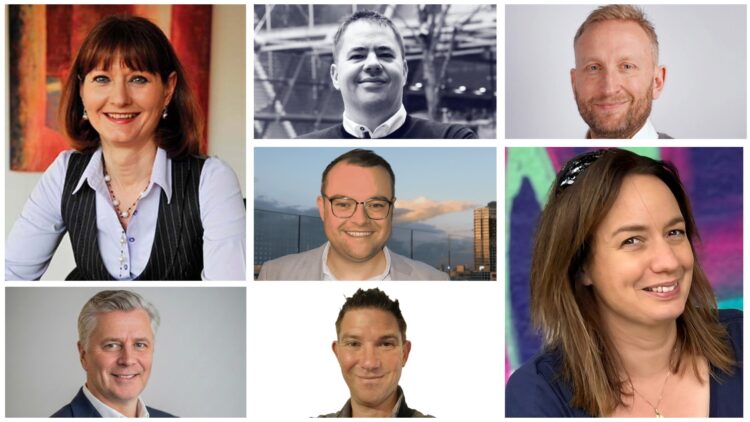

Jody Pawson, Sales Director, Convergent Technology

How big a disruption is this to the way the channel usually operates?

This feels very different to ‘normal’ pricing swings. We’re now seeing some vendors reserve the right to change pricing right up to shipment, while at the same time marking certain orders, especially special builds, as non-cancellable. That can leave the reseller commercially exposed.

Because of that we’ve had to amend our own quotation terms to mirror vendor Ts & Cs.

At the same time, we’re seeing data centre infrastructure pricing increase dramatically (4x) in the last few weeks, and certain Azure workloads either paused or placed into allocation queues. This isn’t limited to one vendor; we’re seeing similar dynamics across all the hyperscalers. The reality is there isn’t an easy answer for customers now. Cloud and on-prem both come with constraints and added cost, so it’s about managing risk rather than avoiding it.

During Covid there were supply issues and price movements, but not this level of exposure written directly into contractual terms. The channel is built around fixed quotations and approved budgets. If pricing moves after a customer has signed off, the commercial risk inevitably gets pushed down the chain.

Ultimately, it means more difficult conversations with customers. With lead times now stretching beyond 100 days in some cases, we’re having to rearchitect designs or look at alternatives just to keep projects on track.

We’re not expecting any improvement until at least October. It does, in some respects, play to our strengths. We’re able to stay flexible and move quickly when market conditions shift like this. We’re not tied to a single route, so we can pivot, whether that’s re-architecting, switching vendor or adjusting deployment strategy, to protect the customer as best as possible. That agility becomes critical in markets like this.

Trustco’s Michelle Cope weighs in on next page…