The CEOs of two of Microsoft’s largest UK partners have applauded the latest Cloud Solution Provider (CSP) changes, saying they will help reward partners who invest while penalising those using Microsoft as a “loss leader” on shallow engagements.

Microsoft last week raised the authorisation requirements for its CSP partners while adding a raft of goodies to help them “drive more renewals and upgrades, retain customers, upsell, and scale their businesses”.

It follows on from its decision to scrap the Microsoft Partner Network in favour of the new Microsoft’s AI Cloud Partner Program. Microsoft has also just slashed the incentives on offer to partners around Enterprise Agreements, and is taking many larger EA customers direct (see here, here and here).

“If you take the changes Microsoft have made to their schemes over the last 12 or 18 months together, all the bits of the puzzle are starting to drop into place,” Softcat CEO Graham Charlton told IT Channel Oxygen.

“They’ve been bold with changing their schemes to fit their new portfolio and the opportunities they’re seeing in things like AI – and they want to play more in the big customer space, which is fine – we get that.

“They’re putting money into the midmarket in all of the different competencies, and now they’re putting some new eligibility criteria in place to make sure there’s a focus on the quality of partnership, as well as just on all the individual skills they need.”

“Reassuringly difficult”

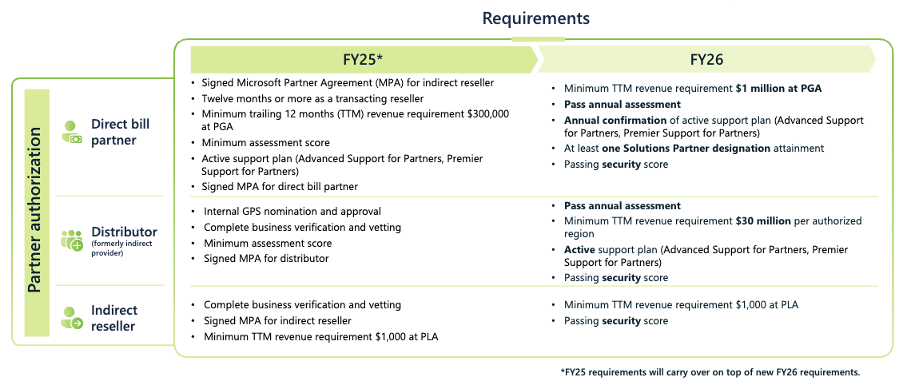

Under the new CSP regime, Microsoft is raising the trailing 12-month revenue requirement for Direct bill partners from $300,000 to $1m and insisting they hold at least one Solutions Partner designation, pass a security score and attain annual confirmation of an active support plan. Distributors must now do $30m in TTM revenue per authorised region.

Talking to IT Channel Oxygen, Geoff Kneen, CEO of Advania UK, said the changes show Microsoft is “looking for more and more proof for clients that they are working with appropriately qualified partners”.

He picked out the addition of the Solutions Partner Designation requirement as his standout headline from last week’s announcement.

“Yes, [Direct bill partners] have now got to be working to a certain level in terms of trailing 12-month revenue, but the important thing for me is that the partner’s now got to be appropriately qualified,” he said.

“It’s saying Microsoft wants to work with partners who can ensure the client is getting value throughout the whole life of their software licencing estate, not just providing a financial transaction.”

Kneen said the changes will make Direct bill CSP status more like Microsoft’s toughest badges such as Azure Expert MSP.

“Azure Expert MSP is reassuringly difficult to attain and maintain, but CSP hasn’t had that kind of level of differentiation before,” Kneen said.

“With the changes that came in a few months ago in EA, certain partners were looking to use the CSP model as more of a transaction-based model – but that’s not what it’s there for.”

“Microsoft don’t want partners using them as loss leader”

Even though partners have got nearly five months before the authorisation changes kick in on 1 October, some partners will opt to give up the ghost on Direct bill status, Kneen predicted.

“I think it will make people ask themselves the question: where do we play in this channel; what is the most appropriate role for us?’,” he said.

“At the moment it’s quite difficult for clients to differentiate [between partners], and I think this is about having the appropriate organisation doing the appropriate thing.”

“Microsoft don’t want partners with shallow capability using them as a loss leader, and I think it will thin partners who have been doing that kind of activity,” Softcat’s Charlton concurred.

“And it will reward partners who’ve built for the long term deeper and broader capability, who will be a good partner for customers not just in one narrow field for one year, but in a broad range over many years.”

Three-year itch

The new three-year contract option on CSP will make it easier for customers to switch from EA and lure more of them into the cloud, Kneen said.

More specifically, Microsoft will launch three-year subscription terms for Microsoft 365 E3 and E5, with or without Teams, as well as Teams Enterprise licenses in CSP, on 1 June, 2025. In addition, effective 1 July, 2025, a three-year subscription for Microsoft 365 E5 Security and E5 Compliance mini suites will also be available.

“There’s a bit of saying ‘okay, we’ve made those EA changes and we’ve had some feedback that actually there’s a few things that aren’t available inside the CSP model that would be nice to have’,” Kneen said.

For some, however, Microsoft’s rhetoric on pushing more customers to CSP isn’t necessarily always matched by reality, with an executive at one large partner branding CSP a “race to the bottom” for resellers.

“Although Microsoft is saying they’re looking to migrate customers to CSP, it all depends on the license suite,” said the executive, who wished to remain anonymous.

“If they’ve got E5, for example, the discounts [on EA] can be anything up to 30%, which from a commercial perspective incentivises the customer to stay on an EA rather than move to CSP. It’s not a big problem for the tier ones, but it is a big problem for [indirect] partners because it’s trashing the upfront margin. I’m doing a lot of deals [for tier-2 partners] on CSP at the moment and the margins can be as little as 0.5%.”

“A catastrophe“

Microsoft Chief Partner Officer Nicole Dezen claimed in a blog post last week that 70% of Microsoft’s incentive pot is now geared towards partners who serve the SME space.

In contrast, Microsoft has been aggressively chopping incentives for LSP partners selling EAs into large enterprises, as Charlton was quick to acknowledge.

The January EA shake up will “reduce the fees and profit income for us licensing for big customers drastically”, Charlton said, before quickly adding that he was “sanguine” about this and that it was the right thing for customers.

“If you had a business that was just in Microsoft licensing for large customers, then this is a catastrophe,” he said.

“If you’ve got a richer offering to customers and you’ve got other revenue streams, then you’re able to deal with this.

“Quite frankly, just licencing for large customers shouldn’t attract a lot of profitability because Microsoft are leaning in and doing more of the work there themselves. This is just about playing together in the right way – so we’ll license and provide services around that for big customers and we’ll let Microsoft do the other work – and we’ll sell the rest of the Softcat range into those big customers.

“So it doesn’t dilute our appetite to work with big customers on Microsoft at all our – it just changes our commercial model.”

The EA fee changes were seen by some as a pivotal factor behind SoftwareOne‘s decision to acquire fellow European LSP giant Crayon – a deal that was accepted by 91.6% of Crayon shareholders last week.

US-based LSP Insight said it expects changes to Google Enterprise resale and Microsoft EAs to leave a $70m dent in its gross profits this year, meanwhile.

Insight CEO Joyce Mullen last week claimed that the solutions integrator giant is “managing through [the changes] quite effectively”, however.

Insight’s mitigation actions are “primarily around ensuring we transition enterprise agreements in the small and medium business and corporate space into CSP agreements”, she stated.

“I think you’ve seen different partners go through the stages of grief on this – we’ve had the full range from denial to anger,” Softcat’s Charlton said.

“We’ve tried to move straight to acceptance.”

“The exposures and the ability to adapt is very different for different players, but we’re very sanguine about it because, although there’s effort involved for us, there’s a tonne of opportunity in it as well.

“And these eligibility changes is exactly the right thing for Microsoft to be doing for customers.”

Doug Woodburn is editor of IT Channel Oxygen